For an airline bucking the trend with strong growth in passengers, revenue and profit, you’d think the latest full-year results from Wizz Air (WIZZ) would be something to cheer.

But the company’s shares are down 5.4% to £30.35 after it said its profit for next year will probably be in the range of €320m to €350m, which is below the market’s consensus of around €360m.

READ MORE ABOUT WIZZ AIR HERE

Its full-year results to 31 March this year however were generally ahead of forecast, with the Budapest-based airline reporting a 6% increase in profit to €291.6m and a 19.6% rise in revenue to €2.3bn.

SOLID IF UNSPECTACULAR

AJ Bell investment director Russ Mould says the airline’s results ‘could be parked in the solid rather than spectacular category’, hence the possible reason for the share price turbulence today.

The 6% rise in profit also compares somewhat unfavourably with the 20% increase posted last year, and Mould adds that its outlook comments referencing exposure to the limited visibility facing the rest of the sector ‘suggests the company isn’t completely insulated from the uncertainty around Brexit either'.

Where Wizz Air’s results are more encouraging is in the strong growth in ancillary revenue - money generated from a passenger’s extra spending once they’ve bought their ticket - which was up 18% to €953m, and now accounts for 41% of the company’s total revenue.

While ticket prices typically fluctuate depending on market response, the price of the other services the airline provides remains relatively stable and so the more money it can bring in through checked bags, individual seat assignments, hotel commissions, etc, the less it will impacted by things like rises in fuel prices for example, something which has caused issues for a lot of airlines.

BETTER ANCILLARY GROWTH

Analysts believe Wizz Air is generally in a better place than its competitors Ryanair (RYA) and EasyJet (EZJ), and when it comes to ancillary revenues this would appear certainly to be the case.

Ryanair, which has made its name out of bringing passengers in with low fares to then offer more in add-ons, for example currently makes 26% of its turnover in ancillary revenues, with an aim to get to 30% by 2020.

In its last set of full-year results, EasyJet said ancillary revenue accounted for 19.5% of its total turnover.

LESS TURBULENCE THAN RIVALS

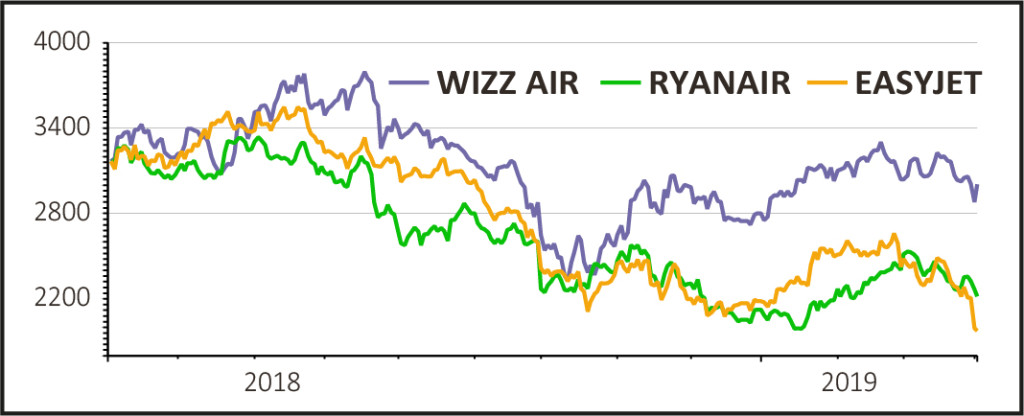

Wizz Air’s shares, despite the resilient trading, haven’t done the best this year and are down around 6% in the past year.

But the market still views the airline more favourably than its rivals, as shares in EasyJet and Ryanair have tumbled around 37% and 30% respectively.

The company’s key market is Central and Eastern Europe, which economically is growing faster than the more Western Europe markets of Ryanair and EasyJet, and means it is less exposed than its rivals to the pressures of Brexit.