Bookmaker William Hill (WMH) is considering an all-share merger with Canadian gambling group Amaya (AYA:TSE), best known for its Full Tilt and Pokerstars websites and estimated to command a 71% share of the global online poker market.

William Hill has been struggling on the digital side while Amaya has had to battle a reputational issue after its former CEO was accused of insider trading.

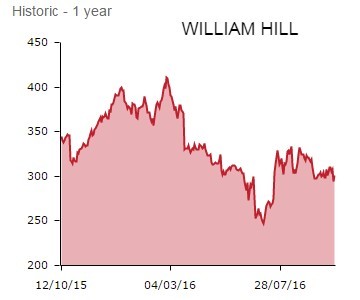

Shares in William Hill tick 2% higher to 300.3p as the pair confirm that 'they are in discussions regarding a potential all share merger of equals' to create a £4.5 billion giant. 'The potential merger would be consistent with the strategic objectives of both William Hill and Amaya and would create a clear international leader across online sports betting, poker and casino,' reads today's statement.

The deal would be structured as a reverse takeover of William Hill by Toronto-listed Amaya against a backcloth of consolidation across the sector. Higher taxes, tougher regulation and a race to increase onine market share are forcing companies across the industry to join forces.

The mooted merger would see the enlarged group retain the London listing with Rafi Ashkenazi, the recently appointed CEO of Amaya, becoming CEO of the new bookmaking behemoth; Ashkenazi is a former chief operating officer of Playtech (PTEC) and in that capacity sat on the board of the William Hill Online joint venture for a couple of years.

Yet to be convinced by is Davy, which sees discussions with Amaya as surprising for a number of reasons. 'Firstly, there is the timing,' write analysts David Jennings and Robert Stokes. 'William Hill faces an imminent regulatory review of betting machines in its shops, which could have a material impact on its future earnings stream. How a potential merger partner could be comfortable with the valuation of the business ahead of such a review is difficult to see.'

'By the same token, Amaya is currently appealing a case taken by the state of Kentucky last year which resulted in a potential fine for the company of $870m (£696m). While it is likely (in our untrained legal view) that this will be reduced on appeal, it is nonetheless a very material sum in the context of a £5.7bn merger.'

'Secondly, a merger with Amaya would represent a significant change of approach by the William Hill board in at least two respects: financial leverage and its comfort levels with unregulated market exposure,' explains Davy. The Irish broker also notes 'the transaction would also signal a willingness on the part of the board to materially increase the proportion of its revenues and earnings coming from unregulated online gaming markets. The group’s share of revenues coming from unregulated markets would increase from less than 4% today to 25% post-merger.'

Davy does of flag 'some strategic merit' to the deal. 'For a start, the combined entity would have diversified scale. Its 2015 earnings base (of nearly £700m in EBITDA) would be 40% higher than our 2017 forecast for Paddy Power Betfair (PPB) for example.' This is before more than £100m of cost synergies are considered.

'Secondly,' says Davy, 'exposure to UK regulatory risk would be materially reduced. Thirdly, aside from the UK, no individual market would account for more than 5% of group revenues and the business would be 60% online, achieving one of the goals of the William Hill board.'