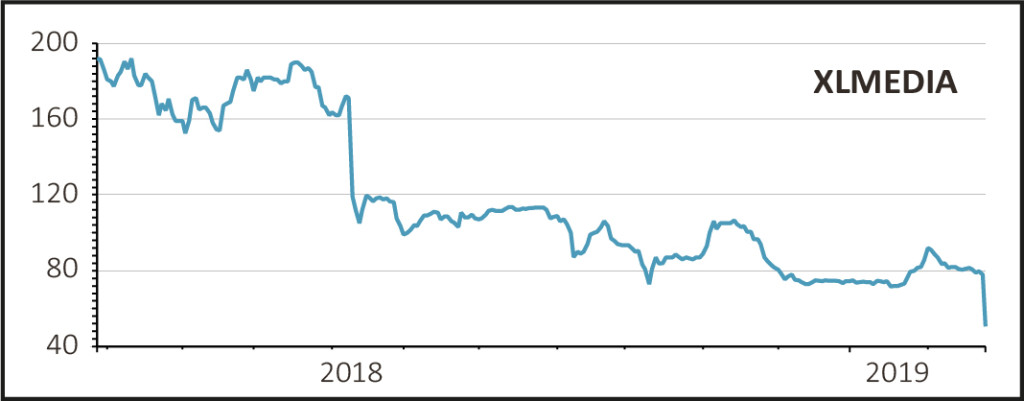

Online gaming marketer XLMedia (XLM:AIM) continues a miserable 12 months as it says a retreat from its media buying business will hit financial performance in 2018 and 2019. The stock is down 33.4% to 52p.

The Israeli firm helps direct players to web-based gambling through a portfolio of more than 2,300 websites - its publishing arm - in return for a revenue share. Sites typically are gambling portals with information on gaming-related topics.

The media part of the group essentially buys online ads for clients. The publishing division is higher margin, though it was hit in 2018 by regulatory pressures on the gambling sector and this prompted a big profit warning last June.

SHOCK FOR SHAREHOLDERS

It was a shock for shareholders who had been used to the company consistently beating expectations up to that point. The shares, having traded as high as 220.5p in December 2017, are now only slightly above the 49p issue price from its March 2014 IPO.

A retreat on the media side, which in 2018 accounted for 40% of revenue and 22% of gross profit, prompts a one-off impairment of between $11m and $13m in 2018

At the same time the company is investing in expanding its publishing assets in the US and this is expected to weigh on earnings in the short term. As a result of this expenditure and the exit from a big chunk of its existing media activities, 2019 revenue will take a $30m hit with earnings reduced by between $6m and $7m.

Despite this news, the company reiterates its commitment to both its ongoing share buyback programme and 50% dividend payout ratio.

House broker Berenberg says: ‘While far from ideal in the short term, we believe this is the best long-term move for XLMedia as it will improve the quality and defensiveness of earnings in the group.’