Limited growth, specialising in an old fashioned software architecture with none of the pizzazz of newer, faster digital start-ups or FAANG giants (Facebook, Apple, Amazon, Netflix, Google).

That’s how whole swathes of investors still see Micro Focus (MCRO).

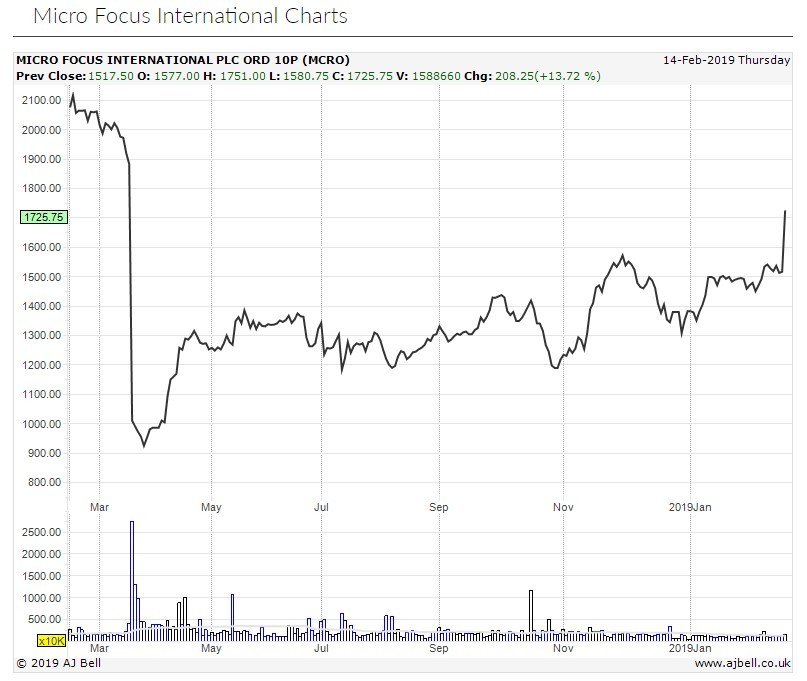

Dull it may be, but its shares have soared more than 14% to £17.335 in morning trade on Thursday adding a staggering near £900m to the company’s market valuation.

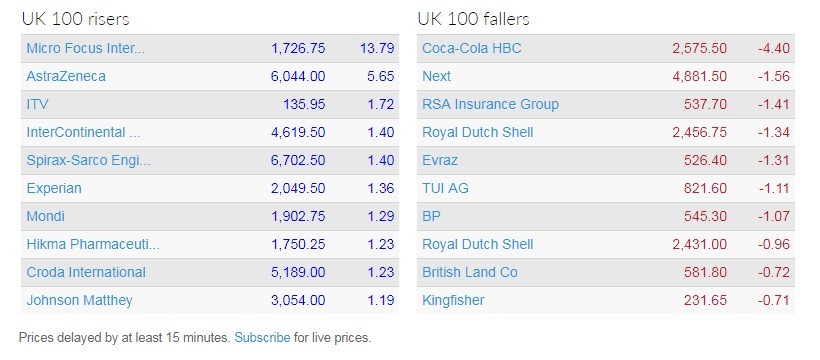

It also puts Micro Focus firmly at the top of the list of FTSE 100 risers, by far - drugs developer AstraZeneca (AZN) is the next biggest riser, up barely more than 5%.

BEATING EXPECTATIONS

Two key points stand out for this immense stock market rally. Firstly, today’s pro forma 12-month results to 31 October 2018 basically beat market (and company) expectations with revenues down 5.3% to $4.06bn and adjusted EBITDA (earnings before interest, tax, depreciation and amortisation) up 9.2% to $1.53bn.

Operating margins came in at 37.7% as the second half of last year made up for a rough first six months dogged by integration challenges.

The second thing to note is that with most of the heavy lifting on sales teams, customer management and finance function disruptions largely complete after its transformative HPES acquisition, the company can get back to doing what it does best - churning out oodles of free cash flow from even modest sales growth and operational streamlining.

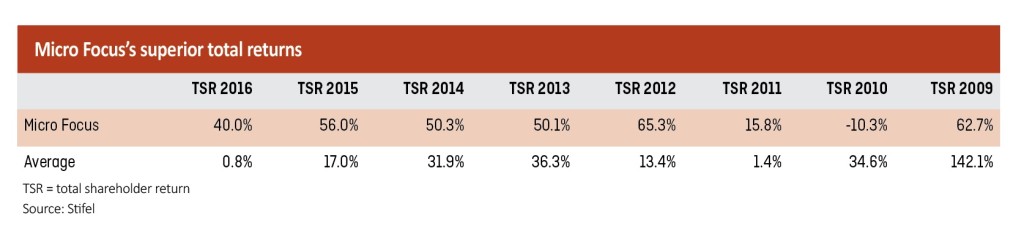

‘Micro Focus had a well-earned reputation as a stock market cash machine in the first part of this decade,’ says AJ Bell investment director Russ Mould.

He calculates that the company returned approximately 600p per share in ordinary and special dividends between 2011 and 2017, prior to the HPES deal.

CRITICAL SOFTWARE YOU MAY NOT HAVE HEARD OF

It may come as a surprise to investors that do not know the company well just how important it is to today’s IT/software/digital world. Micro Focus supplies application and infrastructure management software to clients all over the world.

Its software is used to build, manage, test and modernise applications built on a wide range of platforms, with a large number of operations still focused around the management tools and support for COBOL, the legacy mainframe infrastructure software that still runs many of the world’s mission critical systems.

‘Today’s full year results show some signs it can regain its credibility with investors in this regard as both cash flow, debt and revenue come in better than expected, the dividend is hiked and its share buyback scheme is extended,’ says AJ Bell’s Mould.

‘Now the focus, especially from investors, will be on monitoring what the company does best, improving the EBITDA margin over time and delivering solid shareholder returns through a mixture of good cash generation, and buying, building and selling strategically interesting businesses,’ adds Indraneel Arampatta, of IT business analysis boutique Megabuyte.