European stocks fall to 18-month lows after heavy selling on Wall Street pushed the major US average down overnight. Japanese shares saw heavy selling earlier in the day with the benchmark Nikkei Index down nearly 4%.

US Treasury bond yields continue to rise as interest rates look set for further hikes across the pond. This has pushed up the premium investors require to hold riskier assets including stocks.

On top of rising risk aversion, stock valuations have been stretched for some with even Christine Lagarde, the head of the IMF, calling them 'extremely high'.

A third factor troubling markets is the rise in the VIX index which measures implied volatility for US stocks over the coming month.

While stocks have been touching record highs in the US, the VIX has been trading at some of its lowest levels for several years.

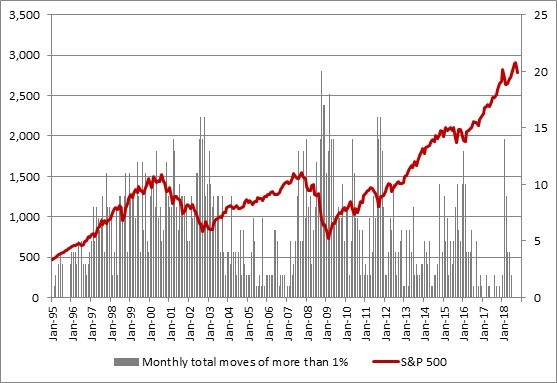

Investors have enjoyed a slow steady rise in the indices and have become complacent about the potential for big moves up or down in share prices.

With shares having sold off sharply in recent days they have started to get nervous about volatility and the index has risen too.

As the chart below shows, the S&P500 index has risen pretty steadily since the 2009 low with one or two wobbles.

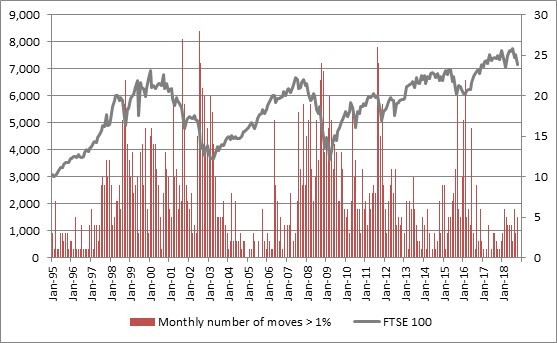

In the UK the FTSE100 has enjoyed a smaller rally with more frequent bouts of nerves but of late volatility has been relatively low.

Matters have been made more complicated by some large investors selling short the volatility index while loading up on momentum-driven technology stocks.

As volatility has increased in recent days this trade has started to unwind, which partly explains why Technology stocks are taking the brunt of the selling.

As is often the case in these situations the tail (short volatility trade) ends up wagging the dog (technology stocks) and private investors are left wondering what’s going on.