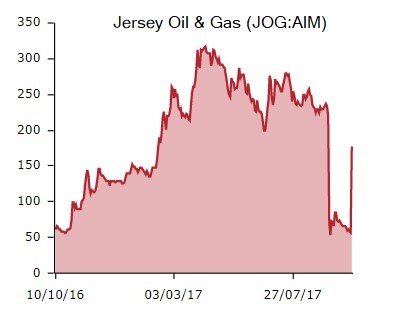

A successful follow-up well on the Verbier prospect in the North Sea has lit a fire under the share price of AIM-quoted oil explorer Jersey Oil & Gas (JOG:AIM). Currently the stock is more than 200% higher at 170p.

Drilled in partnership with the much larger Norwegian operator Statoil, the well has uncovered up to 130m barrels of oil. A previous well on Verbier, in which Jersey has an 18% stake, was less successful and had seen the shares shed more than 80% of their value.

These contrasting fortunes reflect the see-saw nature of exploration stocks and it is notable that the price is still not at the level it was at before the previous disappointing results from Verbier were announced in September (11 Sep). We previewed drilling on Verbier back in February along with three other exploration efforts - to date Jersey’s relative success is the only hit.

The level of volatility at Jersey is more pronounced because Verbier is its only material asset so the destiny of the company is entirely entwined with its success or failure.

Today’s result was delivered by a so-called side-track well. This involves re-entering a well from its surface location but then deviating from the existing hole which has been sunk to target another part of the sub-surface.