Foods-to-fashion retailer Marks & Spencer (MKS) earlier this year warned that its fourth quarter results would be adversely affected by various factors - and that's clear from the very messy full year numbers now presented to the market.

Tough fourth quarter trading running to 1 April 2017, plus one-off items including the costs of shuttering stores and its defined benefit pension scheme, are behind a 63.5% slump in full year pre-tax profit to £176.4m.

This highlights the uphill task chief executive Steve Rowe and newly appointed chairman Archie Norman face in turning M&S round.

You can pick through the results in detail here, though its worth noting that even when one-off items are stripped out, adjusted profits still dropped an alarming 10.3% to £613.8m.

Clothing clobbered

The underlying pre-tax figure is actually not as bad as feared - the Bloomberg consensus before today was pitched at £596m.

Gross margins are also stronger than expected in the Clothing & Home division, for so long M&S’ problem child.

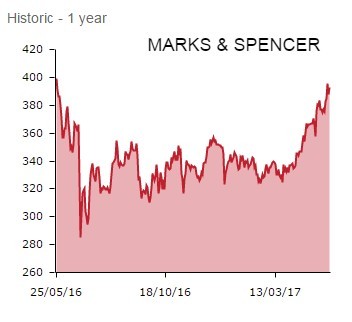

These bits of good news perhaps explain why the share price rises 2.1% to 395.8p on the results announcement.

Elsewhere, sales in Clothing & Home fell 3.4% on a like-for-like basis during the financial year, although M&S is at least selling more stock at full price rather than at a discount.

In the fourth quarter, like-for-like sales returned to their traditional negative trend with a sharp 5.9% fall with the absence of Easter trading keenly felt.

Halfords’ (HFD) boss Jill McDonald has been poached to revive the fashion and homeware arm, though she clearly has her work cut out.

Gloomy outlook

Food saw a 2.1% like-for-like decline in the final quarter, with margins under pressure amid increased waste. Wholesale food price inflation driven by sterling’s weakness is beginning to bite.

M&S is feeling the pain of sterling’s slide, which is pushing up the price of clothes and food at a time when shoppers’ incomes are being squeezed.

Consumers are also choosing to prioritise spending on leisure and entertainment rather than clothing. Furthermore, the high street is in decline amid the inexorable shift towards online shopping.

Bulls may find crumbs of comfort in the year’s strong cash generation, enabling net debt to come down 9.5% to £1.93bn and underpinning a maintained full year dividend of 18.7p.

Today’s results prompt some pretty scathing comments from the experts.

For example, Julie Palmer, partner at Begbies Traynor, comments: ‘In his first year as CEO of the high street darling, Steve Rowe has faced an uphill struggle in his bid to return Marks & Spencer to past glories.

‘While he has focused his first twelve months on addressing many of the retailer’s structural problems, welcoming some retail big-hitters onto the board, closing 30 of its largest stores and converting still more into food-only outlets, M&S is unfortunately still falling behind the curve, most of all when it comes to its notably absent online food offering.'

Palmer argues that ‘with more consumers choosing to purchase both fashion and food online, alongside increased competition in its clothing division from value retailers like H&M and Primark, M&S has a tough balancing act to manage if it is going to attract new shoppers to its stores and sales channels, while being careful not to ostracise its core customer base.’

Retail Vision’s John Ibbotson thunders that ‘M&S has run out of excuses. No amount of stammering about the mild winter or the weak pound can mask the fact that these results are nothing less than awful.’

He adds that ‘for years the brand’s successful food range provided a fig leaf that spared the blushes of its underperforming clothes ranges. No longer - stalling food sales and profit over the past year have revealed the full, naked weakness of the brand’s unappealing clothing lines.’

Furthermore, he says with inflation eating into the profits of the once reliable food offering, and a string of one-off expenses slicing into profit elsewhere, the net result has been to send pre-tax profit tanking by nearly two-thirds.

His views is that ‘M&S remains a dysfunctional dichotomy - premium food with dowdy clothing.’