- Runaway inflation panic ‘unwarranted’, says broker

- UK market ‘very oversold’

- Markets pricing in ‘too much’ of a slowdown in reaction to higher rates

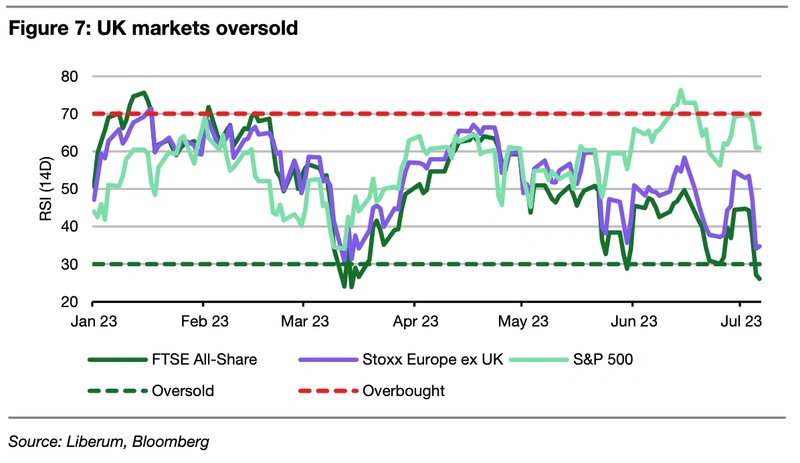

Liberum Capital believes the current panic around runaway UK inflation, that has seen markets price in 100 basis points of additional rate hikes in the second half of 2023 and caused the FTSE 100 and FTSE All-Share indices to fall 3.8% and 4.1% respectively year-to-date, is ‘unwarranted’.

Although the broker’s strategists concede the Bank of England will have to hike rates further to tame inflation, particularly given a resilient UK job market, Liberum argues markets have ‘overshot’ in their inflation and rate hike expectations and by a wide margin at that.

This has created an oversold market that is ‘ready to bounce’.

DON’T THROW IN THE TOWEL

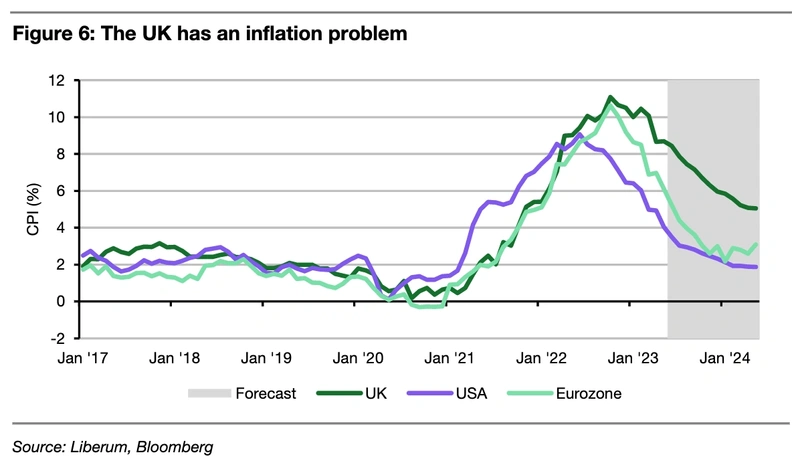

A series of inflation reports coming in above expectations have alerted investors to the fact that UK inflation is different from the Eurozone or the US, with labour market shortages and a lack of productivity growth embedding inflation in the UK economy more than overseas.

And in a note published on 7 July, Liberum strategists Joachim Klement and Susana Cruz explained that the dominating market narrative is one of ‘out-of-control inflation in the UK that requires the Bank to hike rates to 6.5%’.

They argue this ‘excessive pessimism’ about inflation and monetary policy in the UK is keeping ‘a tight grip’ on UK equity markets.

But the encouraging news for investors is they believe markets are ‘getting ahead of themselves’ with their rate hike expectations and pricing in too much of an economic slowdown in reaction to higher rates and investors ‘should not throw in the towel now’.

While Klement and Cruz concede further rate hikes are needed, in their view current expectations have ‘overshot by a wide margin’ and a normalisation of expectations should ‘lead the way to a multi-month bounce in UK equity markets from a summer low’.

WHAT COULD CHANGE THE NARRATIVE?

They see the monetary policy committee (MPC) meeting on 3 August as a likely trigger for a change in narrative.

‘By then, we will also have a few interim results from UK companies,’ says Klement and Cruz.

‘A negative outlook for the second half by businesses, together with weaker macro data (particularly in the housing market) should make it clear that the Bank does not have to hike rates to more than 6% to get inflation under control and we expect markets to price out several rate hikes then. Ironically, this should lift UK stock markets even though it comes on the back of a weaker earnings outlook for H2 2023.’

CAVEAT EMPTOR

However, Liberum’s strategists also flag the risk that macro data remains resilient throughout the third quarter, ‘in which case more rate hikes will indeed be needed. But while this seems to be the central case of investors right now, it remains a risk case to us. Thus, for now, we remain optimistic for UK equities in H2 and expect a rally into year-end starting from a July/August low.’