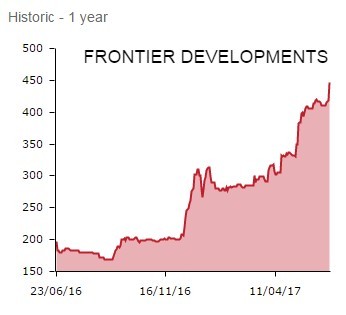

Independent video games creator Frontier Developments (FDEV:AIM) is an eye-catching mover on Thursday. The share price surged 7.4% higher to 450p in early trading on news of a significant step-up in performance last year.

Armed with an increasingly plump cash pile which supports marketing and development spend, the £143m cap also teases investors over a third game franchise waiting in the wings.

Founded in 1994 by David Braben, co-author of the seminal ‘Elite’ game, Frontier expects to report 75% top line growth to £37.3m for the year to May. This is ‘slightly ahead’ of the upgraded guidance given in April, while operating margins should weigh-in towards ‘the top of the 15-20% guidance range.'

Moreover, investors can ready themselves for operating profit of at least £7.2m. That represents a 500% year-on-year surge, although it must be said companies in the video games industry are subject to console launch and game release cycles.

FRONTIER’S ON THE FRONT FOOT

Cambridge-based Frontier uses its proprietary 'COBRA' game development technology to create innovative games with a current focus on video game consoles and personal computers.

Last year’s financials were given an estimated £20m sales boost by the launch of its second game franchise, Planet Coaster, in November. Its original game franchise, Elite Dangerous, ‘the definitive massively multiplayer space epic’, continues to sell well and is about to be released on the PlayStation 4 this month.

‘We now have two strong franchises in the market and have successfully transitioned to a self-publishing business model, proving our ability to launch franchises,’ says CEO Braben, also flagging a £4m year-on-year increase in Frontier’s cash balances to £12.6m.

‘Our ambition now is to build on this success, continue to invest in our franchises and scale up to create a self-publishing multi-franchise success story.'

F3 TEASER

‘Our third franchise, which is based on an enduring Hollywood movie IP of global renown, is scheduled for release in calendar 2018, and we will provide more details about this exciting project later this year,’ teases Braben.

FinnCap’s Harold Evans says last year’s stellar performance encapsulates the Frontier Developments investment case. In his opinion, the company consistently produces quality games, player interest and therefore monetisation is sustained through ongoing development and support, while additional games diversify the revenue and enable step-ups in profit.

However, for full year 2019, finnCap forecasts a surge in pre-tax profits to £14.8m as sales rocket higher to £57m. The catalyst will hopefully be an estimated £34m contribution from the aforementioned third franchise, dubbed ‘F3’.

‘This in our view is a reasonable assumption given that Elite produced an estimated £25m over a similar period without a global brand, which F3 will surely benefit from,’ thunders finnCap’s Evans.

Over at Numis Securities, analyst David Toms writes: ‘The investment case remains unchanged - Frontier has successfully developed and launched two major franchises, and has demonstrated that it can turn a profit whilst also funding the development of a third franchise. Should any of the new or existing franchises be a major hit, there could be significant upside.'