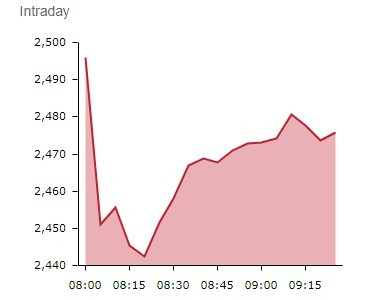

A material increase in Royal Dutch Shell’s (RDSB) full year earnings has got the thumbs down from the market with the share price marked 0.6% lower to £24.81.

They were down by even greater amount when the stock market opened this morning.

So what is going on? As ever it is important to remember that the stock market reaction to a set of results is mainly driven by what investors are expecting.

In Shell’s case the recent surge in the oil price had set a very high bar, so investors already had a good feeling that the results would be very good. Perhaps they expected too much?

Current cost of supply earnings (Shell’s preferred measure of profit) excluding one-off items came in at $15.76bn compared with $7.19bn a year earlier. However, this was only marginally ahead of the analyst consensus figure of $15.72bn.

If one-off items are included, and despite a $2bn adjustment relating to US tax reforms, then Shell’s earnings nearly quadrupled from $3.53bn to $12.08bn.

One of the reasons Shell didn’t beat forecasts was a weaker than expected contribution from its downstream or refining operations.

The company is an integrated oil business whose operations run the gamut from exploration and producing oil, to transporting, marketing and refining it into products like jet fuel and petrol.

While Shell will get paid more for the oil it produces in a higher oil price environment it will also face higher input costs on the crude it refines.

There may also have been some disappointment at a relatively weak quarterly cash flow performance which chief executive Ben van Beurden attributes to ‘higher tax payments and increased cash requirements in relation to our trading business’.