Education technology group RM (RM.) has caught our attention after reporting better than expect profit and finally making an acquisition that could change the dynamics of the business.

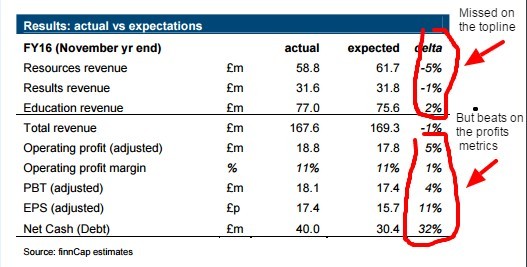

The accompanying table from stockbroker FinnCap shows how the company has made big strides with profit generation in 2016.

I’ve annotated how sales are falling faster than expected in two of its three divisions.

I’ve also flagged where RM did better than predicted: on operating profit, operating margin (albeit marginally), pre-tax profit, earnings and net cash.

The company has delivered on its promise to substantially hike the dividend, up from 5p in 2015 to 6p, equal to a 20% hike.

RM has beaten forecasts from Numis and Peel Hunt, as well as FinnCap.

This suggests that profit quality is gradually improving, helped no doubt by its biggest Education division’s ‘pivot to annuity revenues,’ as Megabuyte analyst Indraneel Arampatta puts it.

A big deal that’s worth it

Today’s £56.5m purchase of Connect Group’s (CNCT) Education & Care division is also important.

The division provides around 40,000 different education-related products to approximately 30,000 customers.

Its range spans from school consumables to safety products via the Consortium and West Mercia brands.

Expected to be merged into RM’s Resources business, the acquisition looks to add a strong range of brands to RM Resources, as well as a solid new customer base for cross-selling opportunities.

RM reported £40m cash balance as of 30 November 2016. The acquisition of Connect’s operations will be funded by cash and debt, having secured a new £75m borrowing facility.

We assume RM will retain a good chunk of its £40m cash pile, particularly as the new business has its own pension scheme deficit which RM will in future have to fund alongside its own.

But there’s a final point to be made. Almost exactly a year ago we wrote: ‘Perhaps the best thing for RM and its rather beleaguered shareholders would be to hitch itself to a bigger learning tech business, because going it alone sure hasn’t worked so far.’

Today’s acquisition seems to hint that chief executive David Brooks is thinking along these very lines. Whether it will amount to much, only time will tell.