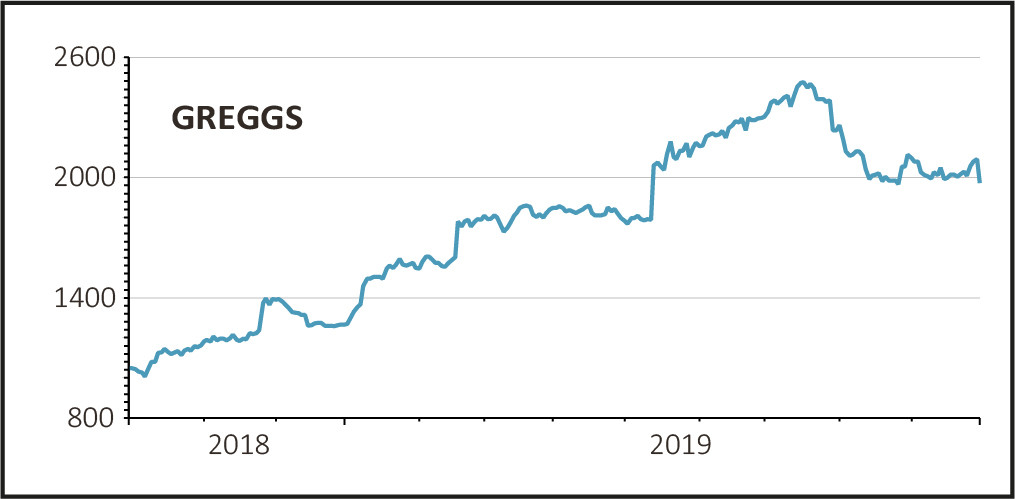

Value sandwiches, coffees and vegan sausage rolls purveyor Greggs (GRG) gave up 4.6% to trade at £19.94 as third quarter sales growth moderated against stronger prior year comparatives. Like-for-like sales at the bakery food-on-the-go retailer still rose by a tasty 7.4% in the 13 weeks to 28 September as innovative new products drove robust footfall.

Yet investors fed a recent diet of upwards earnings revisions were left disappointed by the absence of additional upgrades, while news of pressure from staffing and input costs also weighed on appetite for the stock.

SLOWER GROWTH BITES

As Russ Mould, investment director at AJ Bell, explained, today’s trading update was always going to be a tough one for Greggs. ‘The publicity around its vegan sausage roll earlier this year was so effective that it drove more people to visit its stores and that had such a positive impact on earnings. Sales continued to beat expectations as the year went on, leading to a sharp rise in its share price.

‘The new trading update shows that the rate of sales growth has now moderated, partially because the comparative trading period a year ago was fairly strong.’

Sales at Roger Whiteside-guided Greggs continue to be very healthy indeed, although the pace of new store openings has been scaled back to a net 90 from previous guidance of net 100 additions.

Having passed the 2,000-shop landmark and with an Autumn menu featuring new hot sandwich range additions including Chipotle Chilli Steak and Hot Peri Peri Chicken Baguettes, Greggs is preparing for Brexit by stockpiling key ingredients and equipment that could be affected by ‘no-deal’ disruption.

COST HEADWINDS HURT

‘Overall input cost inflation is in line with our previous guidance to the end of the year, with pressures on both labour and food input costs,’ cautioned Greggs, continuing to expect that ‘year-on-year sales growth in the balance of the year will reflect the strengthening comparatives seen in 2018, and our expectations for the full year out-turn remain unchanged.’

READ MORE ABOUT GREGGS HERE

Mould also added: ‘Interestingly the word “vegan” isn’t even mentioned in the latest update, which might suggest that the buzz around its alternative sausage rolls is starting to die down. There is also no mention of plans to introduce vegan versions of the rest of its product range. Greggs may simply be trying to moderate expectations so that investors don’t get too carried away with this year’s stellar performance.’

Over at Shore Capital, analyst Clive Black insisted that ‘Newcastle’s finest, especially after a Leicester City humping, baker, Greggs, has once again delivered a tremendous top-line performance, especially in the face of wider subdued updates from many high street retail participants.’ Black has ‘huge admiration and respect’ for what Whiteside has achieved at Greggs.

Yet he pointed out: ‘In this respect the market has, however, also noted the achievements of the business through deservedly fulsome equity stock multiples. Such multiples do bring with them the downside risk of disappointment, but at present Greggs’ presses on.’