All Bar One to Harvester pubs group Mitchells & Butler (MAB) reported full-year revenue of £2.2bn, up 4% and pre-tax profit up 11% at £197m for the period ended 29 September.

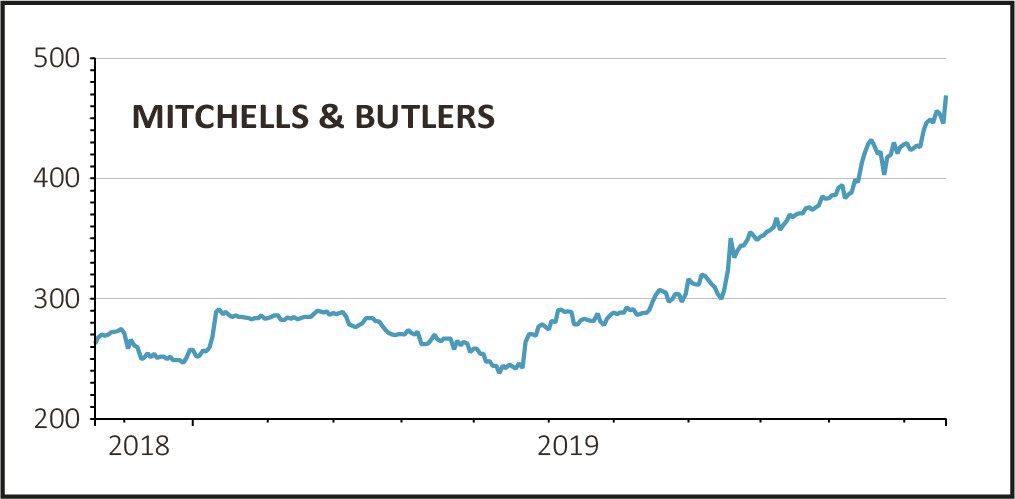

The market was cheered by progress made to improve margins and returns on capital, pushing the shares up 8% to 483p.

Chief executive Phil Urban says: ‘These strong results reflect the work we have done over the last few years, first to build sustained sales growth and then to convert that into profit growth.

‘This puts us in a stronger position as we move forward into the next financial year, in what we expect to remain challenging market conditions.’

MEETING STRATEGIC GOALS

The company completed 240 remodels and conversions resulting in the ‘strongest return on investment in many years’ at 21%. Despite cost headwinds the operating margin improved slightly to 14.2%.

Also mitigating cost pressures was a sharper focus on commercial execution, which saw the procurement team save around £6m over the year by leveraging buying power and running operations more efficiently.

The final leg of the plan is to increase innovation across the platform with the company delivering improvements in the online booking experience. The group is working with Just Eat (JE.) and Deliveroo to improve utilisation of the kitchens which have spare capacity.

The group has been experimenting with an ‘all-day’ premium suburban concept which appeals to punters across all parts of the day and makes better use of the spaces.

CURRENT TRADING

The new financial year has seen continued sales momentum with like-for-like sales remaining ahead of the market, growing 1.4% in a period of adverse weather.

Despite macro headwinds the company remains focused on reducing debt whilst generating value for stakeholders. Net debt reduced to £1.5bn (£1.7bn) which represents 3.6 times adjusted earnings before interest, tax, depreciation and amortisation (EBITDA).