Looking at today’s update from budget airline Easyjet (EZJ), you’d think there would be cause for optimism.

The company said it expects full year profit to be between £420-430m, which is in the upper end of its previous guidance range, bolstered by ‘robust customer demand’ and revenue ‘outperformance’.

In particular, its ability to grow passenger revenue and ancillary revenue - all the optional extras that are offered when you book a flight - per seat is always an encouraging sign for an airline.

READ MORE ABOUT EASYJET HERE

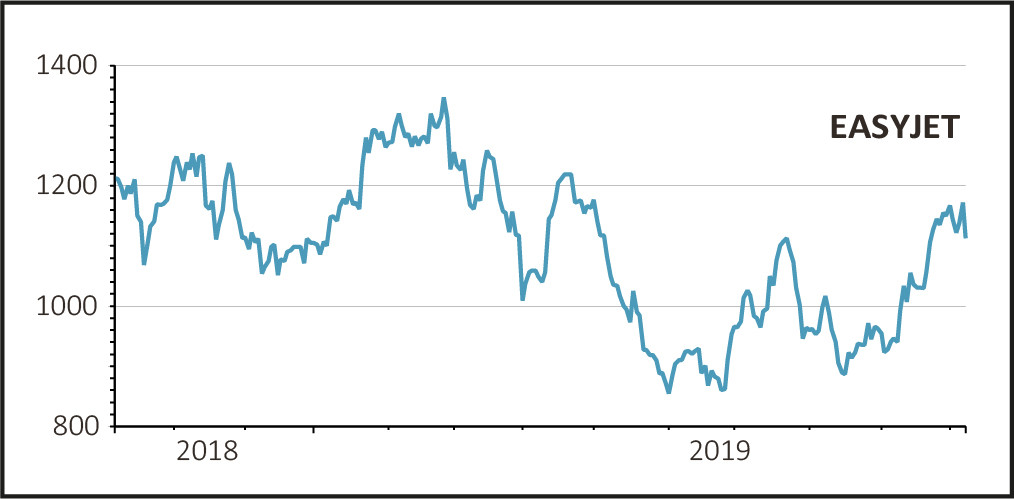

But the market isn’t that impressed, with Easyjet’s shares falling over 6% to £10.98.

This may be because the company failed to offer much clarity on the outlook and, according to AJ Bell investment director Russ Mould, because investors were already expecting good news and today's update wasn’t quite as postiive as expected.

The firm’s share price has performed strongly of late, thanks to the collapse of Thomas Cook and strikes at rivals British Airways and Ryanair (RYA) taking capacity out of the market.

Mould said, ‘The airline industry is such a competitive market that it really amounts to a zero-sum game, with participants gaining when others do poorly and vice versa.

‘With this in mind, the market appears to have already been expecting EasyJet to issue a fairly bullish statement and so the actual news may not have been as impressive as some investors wanted.

‘There was also a reminder in today’s update of the extent to which the company is at the mercy of movements in fuel prices and foreign exchange, with a currency headwind of £14m.’

He added that the company’s commentary on its future prospects offers ‘little reason for genuine excitement’ and that while it has done what it can to prepare for Brexit, ‘there still remains considerable uncertainty over the impact the UK’s exit from the EU might have longer term.’