Despite headwinds from rising input costs and a €23m adverse foreign exchange movement, Coca-Cola HBC (CCH) reports ‘excellent’ first half results helped by an acceleration of sales growth in the second quarter.

Management believes that ‘good volume trends will continue in the second half’ and guides towards a better 2017 sales and margin performance than expected at the start of the year, news that sends shares in the soft drinks colossus fizzing 9% higher to £25.87.

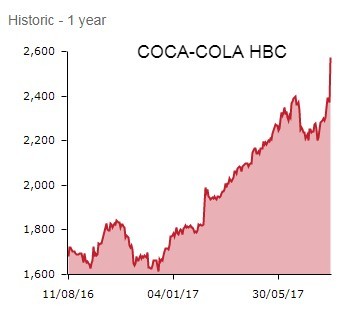

IN AN UPTREND

That share price surge is significant for a lumbering large cap. It reveals investor awareness of Coca-Cola HBC, one of the world’s largest bottlers of The Coca-Cola Company’s brands yet which has been among the blue-chip benchmark’s lesser known lights, is rising.

As the chart shows, Coca-Cola HBC has been in an uptrend since the Brexit vote, investors hunkering down in Coca-Cola HBC for its exceptionally broad geographic footprint - its operations in 28 countries serve a 595m-strong population - and diverse range of low-ticket products spanning fizzy drinks, juices, waters, teas and coffees.

Click here to read today’s results for the six months to June, highlighting forecast-busting 5.7% constant currency top-line growth to €3.2bn with a helping hand from price increases, this year’s late Easter and a late boost from recent warm weather in established European markets. Impressively, profit before tax fizzed up by a third to €254.2m (2016: €190.9m) in the half.

Encouragingly, Coca-Cola HBC’s sparkling beverages business enjoyed good performances in most markets, especially in Ukraine, Romania, the Czech Republic, Hungary and Ireland, more than offsetting declines in Italy and Nigeria. The company also benefited from a number of successful Coke Zero new formula and Fanta flavour launches, which supported the growth in the category.

A notable outstanding performer was the strategically important Energy category. Sales shot up 17.6% in the half with Monster energy drinks, distributed on behalf of Monster Beverage Corp in some markets, enjoying healthy growth in volumes.

CONFIDENT SOUNDINGS

Coca-Cola HBC also reports a 150 basis point increase in operating margin from 7.5% to 9.1%, in the face of increased oil-derived PET resin, sugar and aluminium prices, reflecting the operational gearing effect of strong revenue growth.

Confident soundings from CEO Dimitris Lois are also coaxing in buyers this morning:

‘We are delighted to report an excellent set of results for the first half of the year, with volume and revenue per case growth in all three market segments. It is also very pleasing to see the revenue growth translating into significant margin expansion. This demonstrates that our strategy to exploit our lean asset base and improve profitability through operating leverage is powerful and delivers well.’

Investors’ thirst for Coca-Cola HBC stock is also fostered by the upbeat outlook statement. The company says: ‘We have made another significant step towards achieving our 2020 financial targets in the first six months of the year.

Looking ahead, we continue to expect volume and price/mix growth, as well as better than expected foreign exchange and input cost movements. Altogether, these elements lead us to anticipate better revenue and margin performance in 2017 than we had anticipated at the start of the year.'