Shares in business supplies distributor Bunzl (BNZL) are down 4% to £24.32 this morning despite the firm posting better than expected earnings.

For the year to December adjusted pre-tax profit grew 3% to £559m, slightly ahead of market expectations.

However, there was a small slip in the operating margin due to pressure in the US and the UK and the outlook for 2019 is less clear than the company would like.

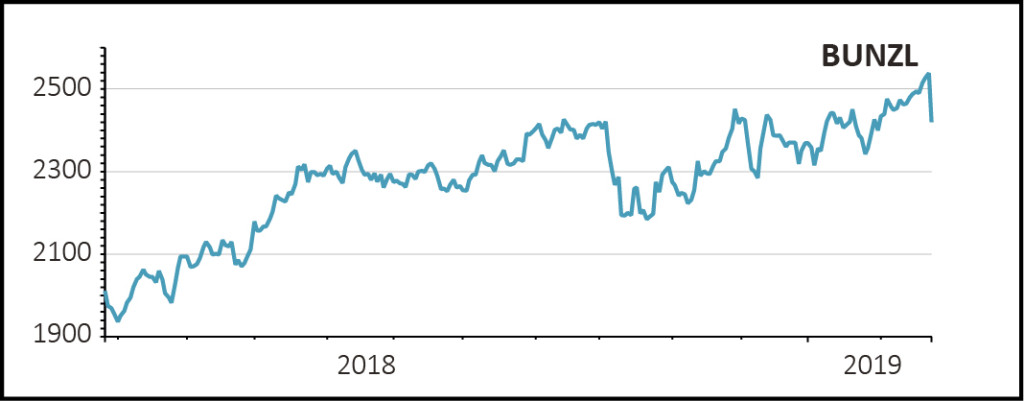

With the shares closing at an all-time highs of £25.39 last week this has inevitably sparked some profit-taking.

STEADY AS SHE GOES

Thanks to a combination of steady like-for-like growth, small bolt-on acquisitions and a constant process of grinding out cost savings, Bunzl has better visibility of earnings than most companies.

This ability to consistently produce higher earnings and dividends year after year has made the stock a firm favourite with fund managers not just in the UK but around the world.

A 15% return on invested capital (ROIC) is one quality metric that will have many other companies casting envious glances at.

Like-for-like revenues were up 4.3% last year with acquisitions adding another 4.7% so on a constant currency basis, excluding changes in exchange rates, turnover was up 9% to £9bn.

However with 87% of sales outside the UK and therefore priced in foreign currencies, the strength of the pound against the US dollar meant that including moves in exchange rates turnover was up 6%.

This is still highly respectable and shows how ‘sticky’ Bunzl’s customers are despite fears over the last couple of years that big beasts like Amazon might move in on its turf.

HIGH VOLUME, LOW MARGINS

Bunzl is a ‘one-stop-shop’ supplying the retail, grocery, food service and healthcare sectors with everything from labelling, packaging and cleaning materials to catering supplies like napkins and medical supplies like gloves and swabs.

The advantage for customers is that Bunzl holds all the inventory and manages the cash-flow, saving them from having to buy in supplies from many different sources while at the same time freeing up working capital and other resources.

Most of its products are small-ticket items sold in large volumes so margins aren’t on a par with some other outsourcing firms.

Last year’s operating profit of £614m means a return on sales of 6.8% which was slightly lower than 2017 due to a tough market in the UK ahead of Brexit and higher operating costs in the US, which is its largest market.

This was mostly offset by strong demand in Europe, in particular France and the Netherlands, and a pick-up in revenues and margins in Latin America, although these regions contribute less than the UK and the US in terms of sales and profits.

ONE OR TWO CLOUDS AHEAD

While the company was generally reassuring regarding the impact of Brexit on its UK business, it did flag that growth had slowed in the second half of last year as some of its customers themselves experienced a slowdown meaning they ordered less products.

It also noted that the healthcare business could face challenges as the government reform of the NHS supply chain goes live this April, at exactly the same time that the UK is scheduled to leave the European Union.

Meanwhile given the drive towards sustainability and away from single-use plastics, which includes some of its disposable product ranges, Bunzl needs to expand its range of alternative products which means higher costs.

Analysts are nudging up their 2019 earnings forecasts but investors will have to hope that Bunzl’s famed stability and visibility doesn’t desert it in what is bound to be a trying period for firms reliant on their customers’ customers.