Fast-growing discount retailer B&M European Value Retail (BME) offers a compelling play on the consumer’s quest for value and convenience.

It is unlikely to have escaped investors that where there has been bloodshed on parts of the UK high street recently (Debehams (DEB), BHS, Mothercare (MTC), House of Fraser, HMV, say) B&M's town centre and edge of town outlets are delivering substantial growth, the company reporting double-digit earnings growth for the year to 30 March 2019.

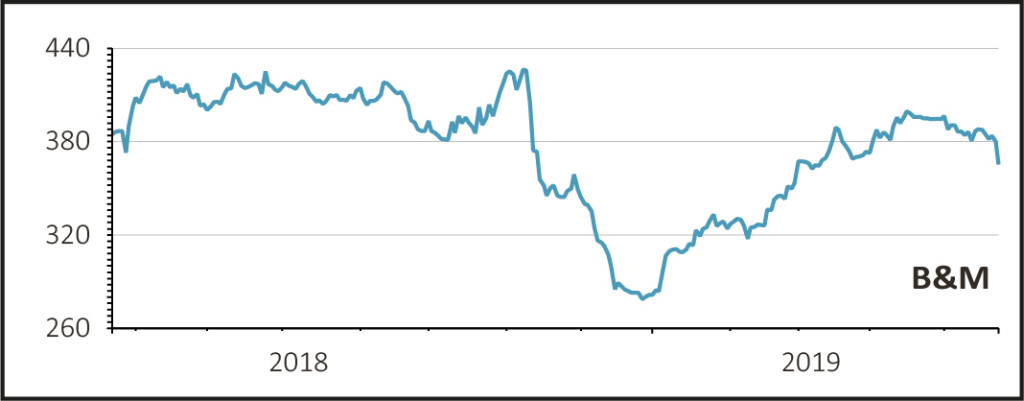

Yet the shares are today down 3.5% to 366.8p as management dampens like-for-like growth expectations and reports a disappointing showing from its German business, Jawoll.

That the stock has rallied roughly 30% so far in 2019 is also a factor.

UK BUSINESS IS BOOMING

First the good news, and there’s lots of it from the Liverpool-headquartered variety goods value retailer with years of growth runway in the UK alone.

Group revenue rose 17.1% to approaching £3.49bn, ahead of the £3.44bn called for by consensus and adjusted pre-tax profit perked up 10.3% to £249.4m, beating the £247m the market was looking for. Earnings per share advanced a healthy 12% to 20.5p, although the 5.7% hike in the dividend to 7.6p may appears a little miserly to some.

READ MORE ABOUT B&M HERE

The retailer’s core UK B&M chain is performing well and generated bumper 5.8% like-for-like growth in the fourth quarter, despite the headwind of the absence of Easter trading. Discount convenience chain Heron Foods traded well and the FTSE 250 constituent’s top line was also boosted by a contribution from acquired French value retailer Babou.

JUMP IN COSTS AT JAWOLL

Unfortunately, B&M’s overall financial performance was hampered by issues in Germany where an EBITDA loss of £10m reflected lower gross margins as Jawoll cleared obsolete stock in order to make way for new ranges, as well as a jump in warehouse costs supporting a move to direct sourcing.

Chief executive officer (CEO) Simon Arora says: ‘B&M has again delivered strong results against the challenging backdrop of continued structural change in our industry, rising costs and uncertain times for consumers, demonstrating that its value credentials remain as resonant as ever with customers, whether they need a bargain or just enjoy one.

‘We have made important progress in establishing platforms for further long term expansion in both Germany and France although there is much work to be done to implement the disruptive, value-led B&M model in these large new markets.’

TEMPERING GROWTH EXPECTATIONS

The core B&M fascia represents 80% of group revenues and encouragingly, ended the year with good trading momentum despite ongoing political uncertainty and not having the benefit of Easter trading. Nevertheless, Arora is tempering growth expectations in the outlook statement, a key catalyst behind today’s share price reverse.

‘I am pleased to report that this strong positive momentum has continued into the new financial year. We just achieved our best ever Easter trading season, with healthy positive like-for-likes, but it would be prudent to expect more moderate like-for-like growth in the full year as a whole’, he cautions.

THE EXPERTS’ VIEW

Liberum Capital remains bullish on B&M, despite results it describes as ‘a slight mixed bag.’

‘We continue to like the long-term story, but there are clearly issues to overcome and international, particularly Germany, needs to show signs of improvement to give greater confidence that B&M’s proposition will resonate and the management can make it work outside the UK.’

Shore Capital says that ‘there remains much to do in the French and German business to bring the B&M direct sourcing model to these markets over the next two years.’

The analysts make the point that the fourth quarter was strong in the core UK business and this trading momentum has continued into the first few weeks of full year 2020 with a record Easter (despite the political backdrop) and mid single-digit like-for-like sales during the period.

‘Management expects that full year 2020 like-for-likes will moderate from these levels in the full year. In our view, this is a business with trading momentum and a winning discount formula that resonates with customers.’