Shares in fishing tackle and equipment retailer Angling Direct (ANG:AIM) leap 10.4% higher to 74.5p on news of a record start to the financial year.

Commentators may carp on about a UK retail sector in distress, but Angling Direct is confounding the wider doom and gloom with like-for-like sales growing strongly as it consolidates a resilient niche market.

READ MORE ABOUT ANGLING DIRECT HERE

Norfolk-headquartered Angling Direct has grown organically and through acquisitions to become the UK’s largest specialist fishing tackle and equipment purveyor. Selling a comprehensive range of over 21,500 fishing tackle products, the retailer has also developed its own brand fishing tackle brand ‘Advanta’, a line formally launched in 2016.

SALES GOING SWIMMINGLY

Angling Direct announces a record start to the year with both its physical stores and e-commerce channel generating ‘robust sales growth’, the AIM tiddler benefiting from ongoing investment in the customer experience and growing brand loyalty.

In fact, like-for-like sales leapt 28.5% higher in February and March, the first two months of Angling Direct’s new financial year, while overall sales were up 50.7% versus the previous year.

Online orders for February and March shot up 27% and Angling Direct also managed to grow European sales by 66% in those two months with German, French and Dutch websites performing well.

Norwich City Football Club-supporting CEO Darren Bailey comments: ‘As we seek to cater for all anglers across the UK with a new and modern retail offering, we will continue to strategically expand our physical geographical footprint, as well as enhance our online offering in terms of products, experience and education in order to help raise the profile of angling.'

He also stresses: ‘Whilst other areas of the retail sector may be experiencing difficulties, we are delighted that our strategic focus on customer experience and service, as well as positioning our stores in the correct locations, is driving our growth and brand value.’

ENTANGLED IN THE RETAIL MALAISE

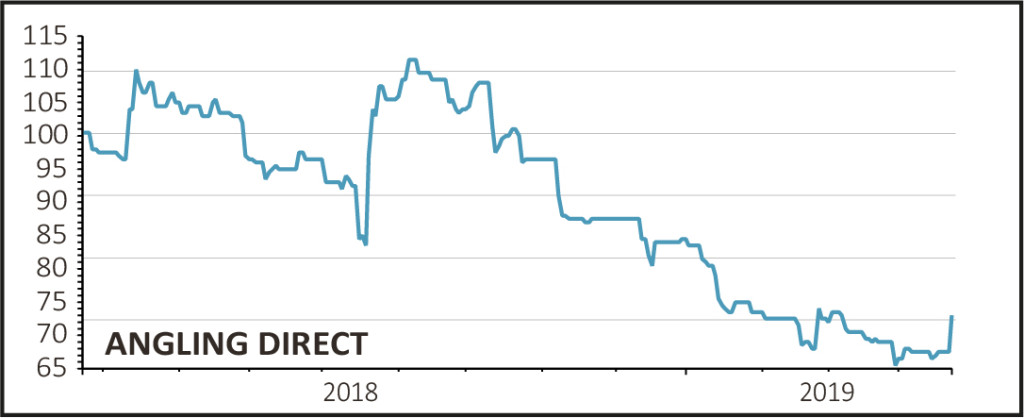

Shares in Angling Direct are the best part of 40% below their January 2018 peak of 119p, caught up in the negative sentiment towards UK retail stocks and with the market also adjusting for last year’s over-subscribed £20m share placing, designed to accelerate growth but also involving some dilution for existing shareholders.

Yet newsflow has been consistently positive, with Angling Direct set to report (13 May) a 38.9% surge in sales to £42m for the year to January 2019, including a doubling of international revenues to £4.66m.

Angling Direct also looks set fair to contend with any Brexit-related disruption given the very high percentage of stocks coming from the Far East.

REELING IN MARKET SHARE

Today’s positive trading update is twinned with the news Angling Direct’s new Nottingham store opened on Friday, bringing the total number of stores across the country to 27.

Previously occupied by Majestic Wine (WINE:AIM), the store is the first fishing tackle ‘destination store’ of its kind in the Nottingham area, located in a very popular angling area near the river Trent.

At a time when a whole host of UK retailers are retrenching from brick and mortar outlets, Bailey insists Angling Direct’s UK store roll out programme remains on track and there are further stores in the pipeline for 2019.

In February, Angling Direct announced the acquisition of Chapmans Angling for £1.4m, this latest acquisition giving the business a strong foothold in the North East of England.