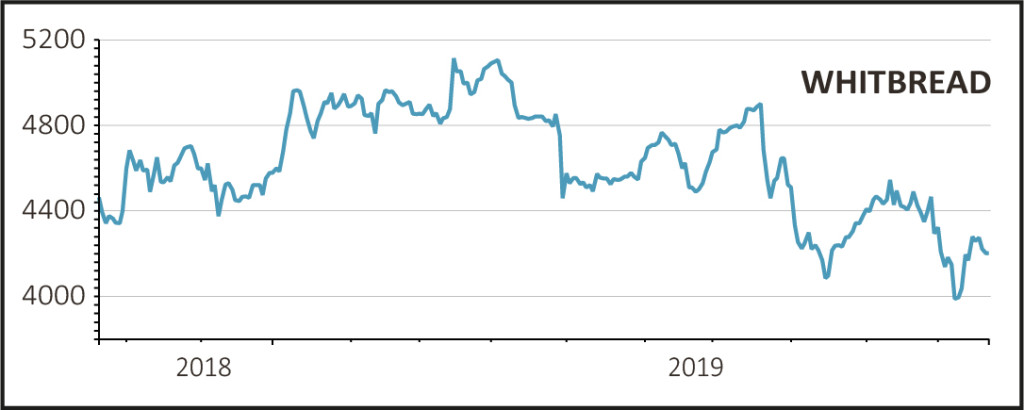

Shares in Premier Inn-owner Whitbread (WTB) have remained broadly flat at around £41.95 despite Brexit uncertainty contributing to a lower half year profit.

In its results for the six months to 29 August, adjusted operating profit fell 7.7% to £296m while adjusted revenue was effectively flat at £1.08bn.

A big drag on its results were the performance of Premier Inn, with its hotels business now in the spotlight after Whitbread sold Costa Coffee to Coca-Cola for £3.9bn, returning £2.5bn of that to shareholders.

Revenue per available room (RevPar) fell 5.2% to £50.19, despite an increase during the period in its room and hotel capacity, with Premier Inn affected more than the wider market following reduced demand in the regions for short-stay, domestic travel.

Because Whitbread’s business model has a relatively high degree of operational leverage, each percentage point on RevPar impacts profit by between £12m to £15m.

READ MORE ABOUT WHITBREAD HERE

‘So far the business has been uncomfortable with the spotlight,’ said AJ Bell investment director Russ Mould.

‘The nature of the operation in the UK, which has a bias towards the regions, is seeing the company lag the wider market. Little wonder first half profit fell.’

Mould said the loss of business travel, particularly regionally, is ‘really hurting’ Premier Inn.

He added, ‘Sending staff away on business is a soft option to scale back when firms are steeling themselves to cope with the current uncertainty.’

The decline in Whitbread’s profit was also partly down to its investment in boosting its presence in Germany, having seen positive performance from a new hotel in Hamburg.

But Mould said its ability to build on this success could be impacted by the economic slowdown in Germany, with the country potentially having slipped into recession according to its own central bank.

Instead, investors will hope innovations such as Premier Plus higher specification rooms - which has a strong balance sheet - can pay off for the business, he added.