The depth and breadth of property services firm Savills’ (SVS) operations can make it a good bellwether for the real estate sector as a whole.

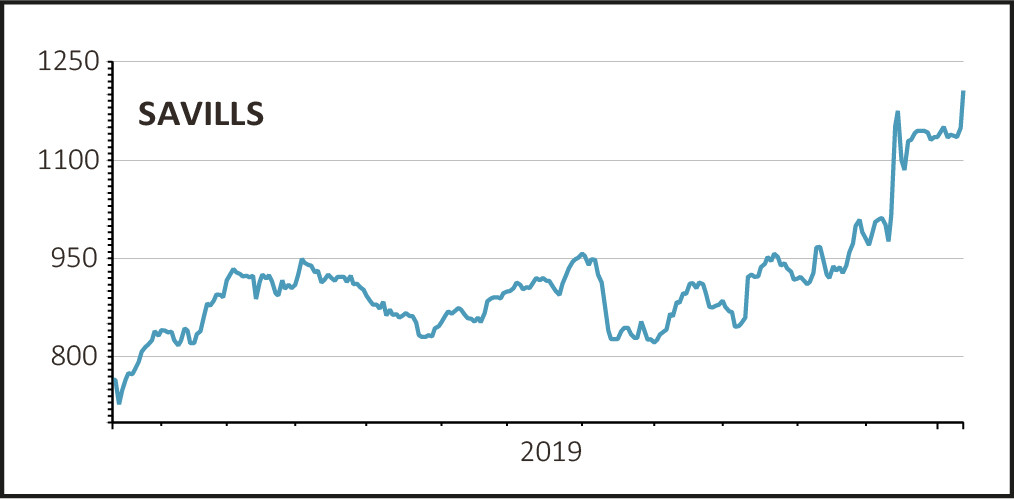

As such today’s year-end trading update - guiding for underlying 2019 results ‘towards the upper end of the board’s expectations’ might look encouraging for the industry. It is certainly pushing the company’s share price higher - up 4.6% to £12.02.

However, look closer at the statement and it feels like this performance was principally achieved despite the market backdrop.

The firm said its business had shown resilience in a year marred by political uncertainty in Britain and in Hong Kong. A clear outcome in the UK general election, however, prompted a strong close to the year.

Savills also pinned its upbeat guidance on ‘significant year-on-year growth’ in the US and a strong performance from its investment management arm.

‘Despite the backdrop of uncertainty, the UK performed well across all business lines, latterly benefitting from improved investor sentiment in both commercial and residential markets,’ Savills says.

The company is clearly not getting carried away, leaving 2020 guidance unchanged as it notes lingering caution in the UK and uncertainties affecting other markets.

Savills will likely provide its next read on the property market, and what, if any, impact the UK’s exit from the European Union on 31 January has had when it announces its annual results in full on 12 March.

Numis analyst Chris Millington says: ‘Savills has delivered results broadly in line with last year, which is better than expected and a great achievement in light of the volatile market backdrop.

Whilst management has reiterated expectations for 2020, we think the outlook is more positive than it was for 2019, given positive post election activity in the UK and that the low levels of activity in Hong Kong are fully factored into estimates.’