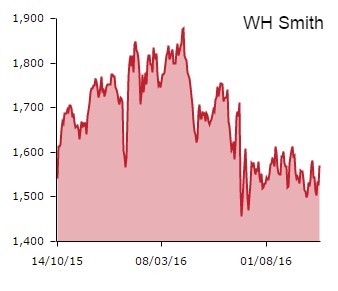

WH Smith (SMWH) has produced its first positive like-for-like sales figure at group level for more than 15 years, according to calculations by Canaccord Genuity. The news helps to drive up the share price by 2.8% to £15.67.

The 1% increase in like-for-like sales in the 12 months to August 2016 was driven by the travel arm. This is WH Smith’s shops in airports, train stations, motorway service stations, hospitals and workplaces.

Travel was up 4% versus a 2% decline in like-for-like sales at WH Smith’s high street stores.

The business has now paid out one quarter of its current market value in dividends to shareholders over the past 11 years.

The latest full year dividend has been lifted by 12% and WH Smith has announced plans to buy back up to £50m of shares.

It is investing in the travel business which now operates from 768 units including overseas sites.

It is looking at how best to use small spaces in travel shops and has shifted the emphasis in some sites to takeaway food, as well as opening dedicated bookshops.

‘WH Smith has delivered another year to its impressive record of profit growth and cash generation,’ says Canaccord.

‘While its travel division tends to grab the headlines given the delta of its contribution to group operating profit growth (£m), along with the higher top and bottom line growth rates (%), the high street division has relentlessly ground out profit growth (and cash generation) for well over 10 years.’

The broker says travel poses the biggest risk to the group, despite being the current growth driver of the business.

This is because Brexit could potentially hurt consumer confidence and economic conditions, thereby reducing passenger numbers, argues Canaccord.

‘Even so, this will be mitigated by continued growth in Travel outlets, domestically and internationally.’