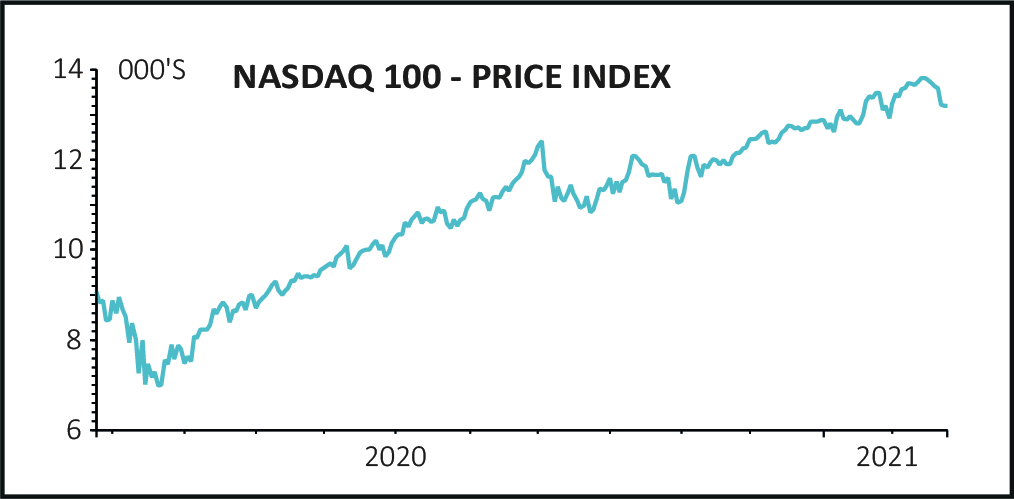

The rout of tech stocks continued overnight on jitters about rising inflation and the potential to push interest rates up. The Nasdaq 100 fell for its second successive session on Tuesday, although bouncing off near-13,000 lows to post a 0.5% decline at 13,465.20.

That makes it six down days in seven for the index since hitting record 13,807.70 on 12 February. Major tech names including Apple, Microsoft, Nvidia, Qualcomm, Alibaba and Tencent fell, while Tesla’s 11% slide since Friday’s close means nearly $80 billion has been swiped off its market value.

NEEDED CORRECTION

‘It is hard to argue that the valuations of high growth stocks had not become stretched and that some rotation into less fashionable names offering greater value was overdue,’ said analysts at Winterflood.

The biggest slide in months for Cathie Wood’s Ark Investment funds is testing the resolve of investors who piled billions of dollars into some of the hottest investment companies on Wall Street. Wood is the founder of Ark Investment Management, one of Wall Street’s biggest Tesla bulls, while Bitcoin is another huge bet.

All five of Ark Investment Management’s active exchange-traded funds slumped on Tuesday, with the company’s $27 billion flagship Ark Innovation ETF tumbling as much as 12% and heading toward its worst back-to-back rout since March.

The selloff came after investors collectively piled $6.2 billion into the product since the beginning of the year, according to data compiled by Bloomberg.

UK INVESTORS EXPOSED

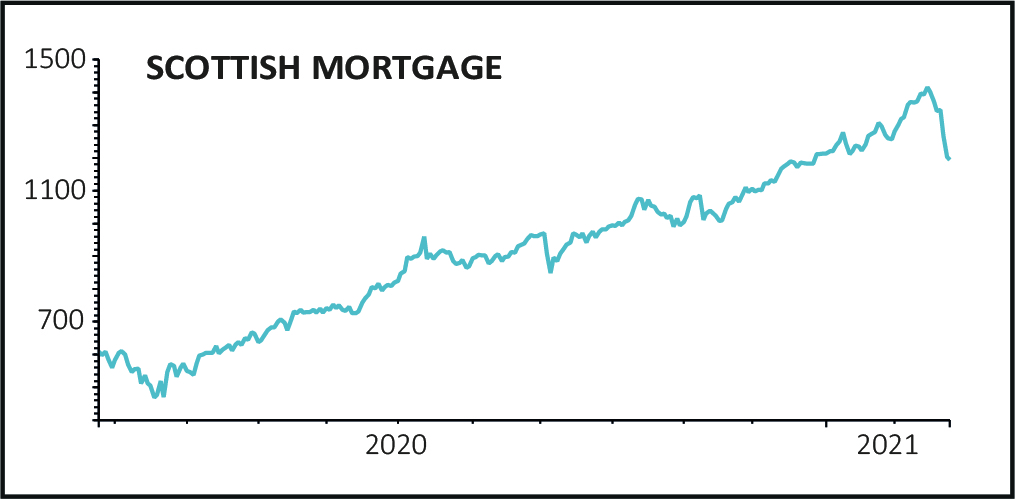

The London stock market does not have the heavyweight technology stocks that US markets do but their impact can still be felt this side of the pond. Scottish Mortgage Investment Trust (SMT) is one of the reasons why.

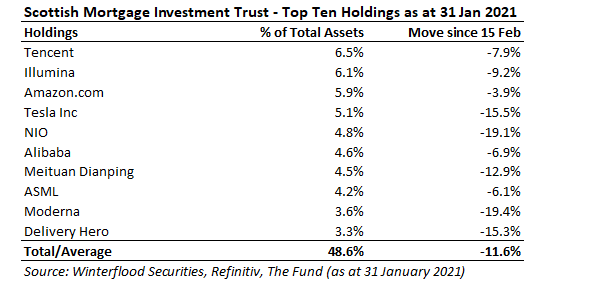

The FTSE 100 investment trust is a big holder of some of tech’s biggest names, including Tencent, Alibaba and Delivery Hero while it is probably best known for being an early mover into Tesla. With technology stocks running into a bit of profit-taking recently, the investment trust’s shares have plunged 15% since the start of last week, although the stock had staged a modest 2% bounce today at £12.26.

Scottish Mortgage’s net asset value (NAV) - the worth of its underling portfolio stakes combined - stood at £12.481 versus yesterday’s £12.03 share price close for a 3.6% discount. The sell-off on yesterday had dragged the stock down 11.4% at one stage during the day.

‘15.5 million shares were traded compared with a daily average over the last six months of 3.6 million,’ said Winterflood. ‘So far this year the fund has delivered a share price and NAV total return of -0.9% and 8.1% respectively, compared with a rise of 1.3% for the FTSE All World Index.

VOLATILITY LEVERS

It is worth bearing in mind that Scottish Mortgage volatility is reduced by its weighting to private companies as they are only revalued periodically. Stakes in unlisted private companies were worth 16% of the portfolio as at 31 January, and the trust has scope to buyback stock to reduce volatility further.

‘We believe that yesterday’s decline of up to 11% at one stage represented a buying opportunity,’ said Winterflood, whose analyst remain firm backers of the trust’s long-run value creation potential.

‘On a longer-term view, we believe that Scottish Mortgage continues to offer investors unique exposure to high growth companies around the world, both listed and private. While it would be unrealistic to expect returns in the order of that seen in 2020 every year, we believe that the investment approach provides the potential for substantial outperformance for long term investors.’

DISCLAIMER: The author owns shares in Scottish Mortgage