US stocks markets scaled new all-time highs after consumer prices and producer prices came in cooler than economists expected, potentially opening the door for the Federal Reserve to loosen monetary policy sooner.

Fed chair Jerome Powell welcomed the latest inflation data but remained hawkish in his view that rates would remain on hold until Fed committee members gained more confidence in the sustainability of the downward trend in inflation.

The Fed’s new summary of economic projections saw a slight uptick in core PCE (personal consumption expenditures) by the end of 2024 as base effects kick-in while the median number of rate cuts fell to one cut amidst a wide dispersion of views among committee members with four projecting no cuts at all.

Bond yields fell across the board with the 10-year treasury yield dropping from 4.45% to 4.27%, one of the biggest moves since December 2023 as investors priced in lower inflation. Inflation expectations implied by yields on inflation-linked bonds declined to 2.2%, the lowest since the start of the year.

Technology stocks were prominent among the S&P 500 leaders buoyed by excitement over AI (artificial intelligence) deals. Broadcom (AVGO:NASDAQ) led the pack, hitting a record high boosted by demand for AI-linked chips.

At the other end of the spectrum Paramount Global (PARA:NASDAQ) fell 13% on disappointment a deal with Skydance media is not moving forward as hoped.

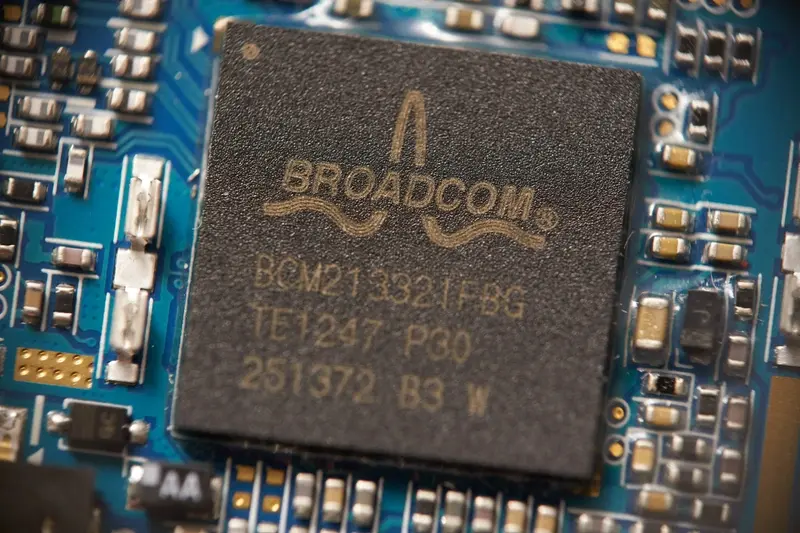

BROADCOM

Could Broadcom (AVGO:NASDAQ) be the next member of the exclusive trillion-dollar club? Yes, say analysts at Bank of America, in response to estimate-beating earnings and the chip firm’s 10-for-1 stock split plan.

Investors cheered the semiconductor manufacturer and the share price soared, rallying 12% on Thursday (13 Jun) for a near-20% surge during the past week, to close at an all-time high of $1,678.99 for a market cap of $776 billion.

Bank of America thinks Broadcom has even greater potential even after its big quarterly report.

In a note, its analysts upgraded the firm’s price target to $2,000, indicating about 18% upside from current levels, calling the firm a ‘a top AI (artificial intelligence) pick’ that appears ‘uniquely positioned to grow’ in areas such as custom AI chips, ethernet networking, and VMware (VMW:NASDAQ) upsell capacity.

Broadcom is one of a growing number of semiconductor manufacturers that have been buoyed by the AI frenzy, as their chips are used to power the underlying software. $3.1 billion in sales during fiscal second quarter (to end Apr) were tied to AI products, the company said. Strong sales ahead also helped Broadcom surge on Thursday, as it forecast $51 billion revenues this year, slightly above consensus.

These are factors not missed by Shares, which flagged Broadcom in our cover feature on quality stocks this week.

ORACLE

On 11 June Oracle (ORCL:NASDAQ) was able to shrug off weaker than expected quarterly results as it announced it had struck two new AI partnerships that will leverage the data giant’s AI infrastructure, one with ChatGPT developer Open AI and its backer Microsoft (MSFT:NASDAQ), the other with Alphabet’s (GOOG:NASDAQ) Google Cloud.Teaming up with Microsoft and OpenAl will help extend the former’s Azure Al platform and provide extra capacity for OpenAl.

It is a similar deal with Google Cloud, where the pair will integrate their powerful cloud computing capabilities inside Google Cloud, including the building of a dozen new datacentres.

‘We expect the Oracle database to be available within the Google Cloud in September this year,’ Oracle said.

While the numbers did come in short of forecasts, this was only a modest miss, Q4 adjusted EPS (earnings per share) coming in at $1.63 on revenue of $14.3 billion, versus Wall Street consensus pitched at $1.65 on revenue of $14.6 billion.

Remaining performance obligations, a gauge of booked revenue, climbed 44% to $98 billion, which would have helped lift the mood, with Oracle recognising more cloud revenue than licence support for the second consecutive quarter, according to Megabuyte’s Jack Wilson-Fowler.

GENERAL MOTORS

General Motors’ (GM:NYSE) shares sped 5% higher to $47.7 this week, taking year-to-date gains to 30%-plus, despite an EV (electric vehicle) forecast production cut from the Detroit-headquartered car maker.

Investors welcomed a fresh $6 billion share buyback plan (11 June) from the Mary Barra-bossed company, which is counting on robust demand for its gas-guzzling models at a time of uncertainty over the adoption of all-electric vehicles.

General Motors, whose iconic brands include Chevrolet, GMC, Cadillac and Buick, now sees the higher end of its 2024 EV production will be 250,000 units, a downgrade from management’s earlier 300,000 unit forecast.

‘We are very focused on the profitability of our ICE (internal combustion engine) business, we’re growing and improving the profitability of our EV business and deploying our capital efficiently,’ explained chief financial officer Paul Jacobson. ‘This allows us to continue returning cash to shareholders.’

Back in November, General Motors announced a $10 billion share buyback after reaching a new labour agreement with the combative United Auto Workers union.