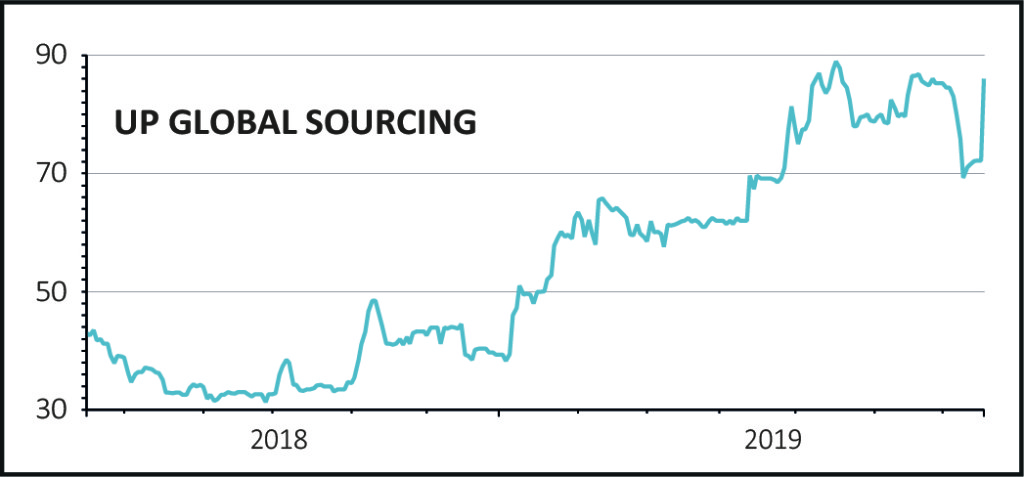

An unscheduled trading update from Ultimate Products (UPGS:AIM), the owner and developer of value-focused consumer products, has put a rocket under the shares, sending them up 15% to 83p.

The company said that it has continued to trade strongly across all routes to market since the interim results announced on 29 April, in other words on-line, through discounters and supermarkets and to international customers.

The board is now guiding for revenues to be between £121.5m to £122m and for underlying profit before tax for the year ending 31 July to be ‘above the market’s current expectations’. According to Reuters the consensus was for revenues of £119m and profit before tax of £7.5m.

READ MORE ABOUT ULTIMATE PRODUCTS HERE

While the top end of the new revenue guidance only represents a 2.5% improvement, the company's large operational gearing means that more of those extra revenues will turn into profits.

House broker Shore Capital has upgraded its profit forecast by 10% to £8.3m, which results in EPS of 7.9p or year-on-year growth of 46%. The broker anticipates upgrading next year’s earnings in due course.

On Shore Capital’s updated numbers, analysts say the stock trades on a ‘modest’ price-earnings-ratio of 9.1 times and a forecast dividend yield of over 5%.