Stocks in London were higher at midday on Monday, amid positive news for the Chinese property sector and hopes that US interest rates will soon hit their peak.

The FTSE 100 index was up 29.50 points, or 0.4%, at 7,494.18. The FTSE 250 was up 81.75 points, or 0.4%, at 18,618.51, and the AIM All-Share was up 0.87 of a point, or 0.1%, at 742.30.

The Cboe UK 100 was up 0.4% at 746.17, the Cboe UK 250 was up 0.6% at 16,283.69, and the Cboe Small Companies was up 0.4% at 13,061.71.

Beijing on Monday reduced borrowing requirements for homebuyers and encouraged lenders to cut interest rates on existing in a bid to shore up its embattled real estate sector. The news revived hopes that the Chinese economy may soon turn a corner.

News that battered developer Country Garden had won approval from creditors to extend a deadline for a key bond repayment also provided some much-needed relief from worries over the Chinese property sector on Monday, further bolstering market sentiment.

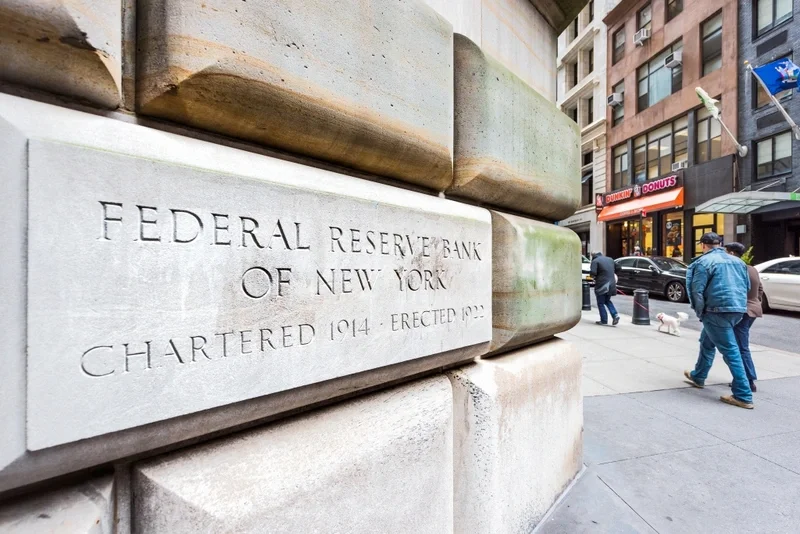

August’s US jobs report, released on Friday, also remained a key driver of sentiment on Monday as it fuelled hopes the US Federal Reserve may make no change to rates when it meets later this month.

According to the US Bureau of Labor Statistics, total non-farm payroll employment increased by 187,000 in August, picking up from a revised rise of 157,000 in July. July’s figure was revised down by 30,000 from 187,000.

August’s figure came in stronger than expectations, with the market expecting 170,000 jobs to be added last month according to FXStreet-cited consensus.

KCM Trade’s Tim Waterer said that the Federal Open Market Committee will be ‘reasonably happy’ with the figures as the push higher in the unemployment rate indicates a cooling labour market which ‘at the very least’ will help buy the US central bank some time to keep interest rates steady this month.

Currently, markets see a 93% chance of interest rates standing pat at the Federal’s Reserve next meeting, according to the CME FedWatch Tool. Just one week ago, markets saw a 78% chance of this outcome.

In recent weeks, a slew of softer economic data has painted a picture of a slowing US economy, fuelling hopes that interest rates in the world’s largest economy have peaked.

Ricardo Evangelista, senior analyst at ActivTrades, said, against this background, the ‘goldilocks scenario’ of a ‘soft landing’ in the US - with inflation decreasing and the economy slowing but not entering a recession - appears ‘increasingly achievable.’

The next FOMC meeting will be held on September 19 and 20. At its last meeting in July, the US central bank raised its funds rate by a quarter percentage point to a target range of 5.25% to 5.50%.

In London, AstraZeneca rose 0.5% as it announced that its drug Calquence is now approved in China for treatment of chronic lymphocytic leukaemia or small lymphocytic lymphoma in adult patients who have received at least one prior therapy.

Calquence already is approved for treatment of CLL and SLL in the US and Japan and is approved for CLL in the EU.

In the FTSE 250, Wizz Air added 2.1% as the budget airline reported its passenger numbers in August rose 24% year-on-year to 6.1 million, while load factor improved to 94% from 91%.

Wizz’s Dublin-based counterpart, Ryanair, said passenger numbers rose 11% annually to 18.9 million in August, as load factor rose to 94% from 89%.

It also revealed around 63,000 of its passengers saw their flights cancelled during last week’s air traffic control failure which caused widespread disruption across the industry and left thousands of passengers stranded overseas.

The Irish carrier said more than 350 of its flights were cancelled on August 28 and 29 due to the UK air traffic control issue.

Elsewhere in London, Capricorn Energy climbed 3.3% as the Edinburgh-based oil and gas explorer benefited from elevated oil prices.

Brent oil was quoted at $88.67 a barrel at midday in London on Monday, up from $88.00 at the London equities close on Friday.

The commodity has been boosted by the prospect of stronger demand from China and the US, as well as tighter supply from major oil-producing nations such as Saudi Arabia.

Gold was quoted at $1,940.67 an ounce against $1,938.09, meanwhile.

On AIM, Advanced Medical Solutions plunged 24% after the surgical dressings company lowered its full-year outlook due to uncertainty over royalty income from its patent licensing agreement with Organogensis.

‘Given that Organogenesis has withdrawn its own guidance and that we have no control of, and minimal insight into its sales, we are unable to quantify the financial impact on AMS at this stage,’ the company explained.

As a result, AMS removed this royalty in its entirety from its fourth quarter guidance onwards, expecting a £2 million hit to adjusted pretax profit for 2023 from lower royalty revenue.

In European equities on Monday, the CAC 40 in Paris and the DAX 40 in Frankfurt were both 0.5% higher.

The pound was quoted at $1.2635 at midday on Monday in London, up from $1.2604 at the London equities close on Friday. The euro stood at $1.0804, higher against $1.0792. Against the yen, the dollar was trading at JP¥146.35, higher compared to JP¥146.21.

Copyright 2023 Alliance News Ltd. All Rights Reserved.