- Inflation to fall while growth recovers

- UK to outperform its EU neighbours

- US ‘soft landing’ more than priced in

Advisory firm PwC has published what it calls ‘a more rosy view’ of the UK economy in 2024 compared with a year ago, with inflation returning closer to normal levels and real incomes improving.

This chimes with the consensus view that the US economy will pull off a ‘soft landing’, but if either view is wrong there could be pain ahead for investors.

MORE GOOD THAN BAD

In a report titled ‘The Good, the Bad, and the Optimistic’, PwC chief economist Barret Kupelian estimates the UK will be the fourth-best performing economy in the G7 this year ahead of France, Germany and Japan, with real GDP (gross domestic product) around 2.7% higher than 2019.

Northern Ireland, Wales and Scotland are seen growing faster than the UK average, while the increase in the national living wage from April and easing food and energy inflation should mean low-income households see an improvement to their living standards.

As a result, for the first time since 2021 consumer sentiment is seen rising to the point where more households expect to be better off in 12 months than worse off.

Despite an uptick in the first quarter, inflation is seen falling faster than the Bank of England is projecting and will get close to the central bank’s 2% target by the year-end.

On the negative side, average rents are seen rising further with the average in London reaching £2,000 per month or 20% more than before the pandemic, while business insolvencies are set to increase, especially in hospitality, manufacturing, transport and storage.

NO ROOM FOR DOUBT

Meanwhile, The Wall Street Journal cautioned readers last week that ‘the most crowded trade’ on Wall Street for 2024 is a soft landing for the US economy.

‘At the end of 2022, investors thought recession was a done deal. The year before, they thought big tech would be immune to rate increases. And a year before that, they were convinced that paying high prices for stocks popular with the wider public would make them rich’, observes the newspaper.

‘This December (2023), they believe, again with absolute conviction, that the economy is heading for a soft landing and lower interest rates. Maybe this time they will be right. Then again, maybe not. Being in the crowd is always an uncomfortable place for an investor, but agreeing with such a strong consensus is especially difficult, because if it turns out to be wrong, the punishment from the markets will be painful—just as it was in each of the past three years.’

The fact is, neither bonds nor equities are priced for a scenario which differs from the consensus – bond yields have fallen and equity valuations have soared, especially for the top echelon of US stocks, all on the basis the Federal Reserve will start cutting rates by this March.

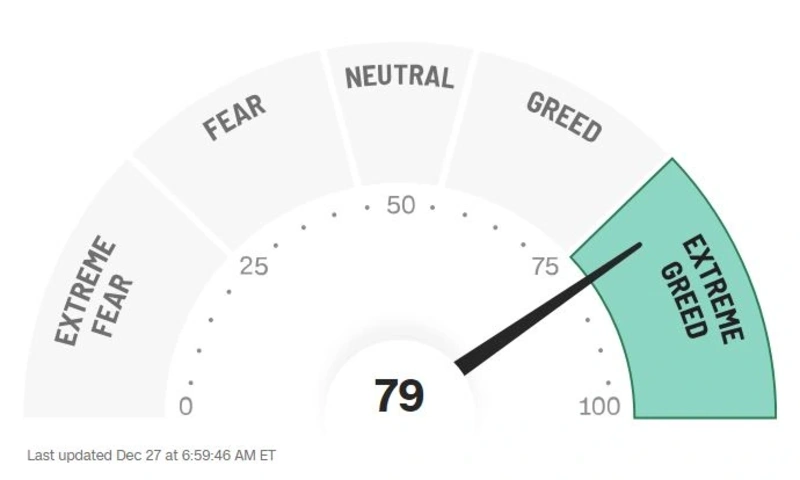

At the same time, no-one is forecasting a reacceleration of inflation, which could be just as damaging to valuations and stock prices – instead, investors have flipped from Extreme Fear to Extreme Greed in the space of just two months.

Considering each of the past three years had a similarly strong consensus, which proved entirely wrong, there is a lot riding on a positive outcome.

The risk seems to be greater on the downside, the paper concludes – even if the US does achieve a soft landing, so much has already been priced in that ‘the market gains to be had from betting on something happening that pretty much everyone agrees will happen aren’t likely to be large’.