Marmite, PG Tips and Ben & Jerry’s owner Unilever (ULVR) is in the spotlight again as one of its top shareholders, Allianz, has been reported as saying it supports breaking up the firm following a failed takeover bid from ketchup king Kraft Heinz.

Allianz fund manager Matthew Tillett told The Telegraph over the weekend that spinning off Unilever’s food division ‘makes sense’.

The move may involve big brands such as Hellmann’s mayonnaise and Magnum ice cream being separated from Unilever's personal care division into a new company.

Currently the food division accounts for nearly a quarter of Unilever and includes several household names, which means it could become a potential takeover target if spun out.

Unilever’s personal care division represents approximately two-fifths of turnover, which means a food spin-out would enable management to focus on the bigger business.

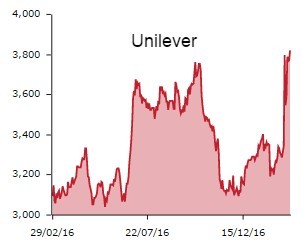

Many investors are supportive of the idea as Unilever gains 1% to £38.14 following pressure on management to take action to boost the performance of the business.

On Wednesday, Unilever announced a comprehensive review to ‘accelerate delivery of value for shareholders’, which is expected to be completed by early April.

However this is not the only move available to Unilever after it rejected Kraft Heinz’s £143bn takeover bid as it saw ‘no merit, either financial or strategic' in the mooted mega-merger.

Management could potentially deliver more value to shareholders by pursuing large-scale acquisitions. The Sunday Times reported that Unilever has been linked to a bid for toothpaste giant Colgate-Palmolive, which may be an ideal strategic fit.