Investors have a long-standing love affair with UK banks. Much like popular retailers, investors like that they can be clearly seen on Britain’s high streets and you can easily stroll into a branch and see the bank at work.

This means UK bank stocks regularly feature on lists of the most traded. Lloyds (LLOY) and Barclays (BARC) come in at number two and four respectively in today’s table, according to Morningstar data.

All four of the UK’s major high street banks (HSBC (HSBA) and Royal Bank of Scotland (RBS) are the other two) are in the top 20.

REASONS FOR CONCERN

Yet latest research by the number cruncher at stock broker Liberum suggest that now may be a good time to take profits. The analysts worry about moderating inflation pointing to range bound bond yields while flat mortgage rates against increased funding costs could tip the returns scales against them on net interest margins.

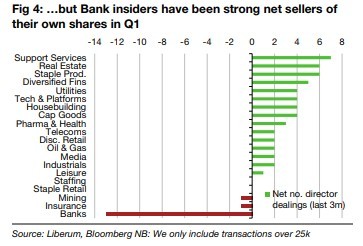

But perhaps more interesting is the industry mood, and what can be learned from insiders, or in other words, the relative buying and selling of stock by bank directors.

LARGE NET SHARE SALES

The chart shows bank share sales massively trump buys, and by a huge margin compared to any other sector.

Many investors may well have profits to trim. Over the past 12 months or so all four of the big UK banks have enjoyed firm share price runs. Barclays is up more than 20% since November, the best performance of the lot.