Don’t worry if you missed the 30 November 2019 deadline to open a Help to Buy ISA to help fund your quest to get on the property ladder. The Lifetime ISA is a very good alternative and comes with the potential to earn a much greater Government bonus, and it has a less onerous restriction on the maximum property value outside London.

Read on to discover more about these benefits (and one downside) and some suggestions for where you might want to put your savings depending on when you are planning to buy your first home.

HELP TO BUY ISA VS LIFETIME ISA

While the Help to Buy ISA is no longer open to new applications, anyone who opened an account before the end of last month can keep paying into the wrapper until 1 December 2030, or switch into a Lifetime ISA.

For those not already paying into a Help to Buy ISA, your only option to now qualify for free money from the Government to buy a first home is the Lifetime ISA.

Both the Help to Buy ISA and Lifetime ISA get the same 25% Government bonus, but with the Help to Buy ISA this is limited to the first £12,000 saved, meaning a maximum bonus of £3,000. With the Lifetime ISA you can get up to £1,000 a year in Government bonus, up until the age of 50. If you opened a Lifetime ISA at age 18, the maximum Government bonus will be £32,000.

Anyone who saves into a Help To Buy ISA can withdraw their money when they want, without penalty. In doing so, you’ll simply not qualify for the Government bonus as that is paid only when you buy your first home.

The Lifetime ISA pays the Government bonus every month and you will be charged a 25% penalty of the entire amount withdrawn if you want to take the money out before buying your first home or reaching age 60. Terminally ill people are allowed to withdraw money without penalty at any age.

The Help to Buy scheme can be used on properties up to the value of £450,000 in London but only £250,000 outside. This has caused issues for those wishing to buy outside the capital and explains why the North West accounts for the biggest share of purchases, where property prices are often much lower. The Lifetime ISA limit is £450,000 and applies nationally.

A Lifetime ISA can only be opened by anyone aged 18 to 39

You need to deposit money in the same tax year you opened the Lifetime ISA

You have to open and fund the account at least 12 months before you buy a property

You can’t pay into a cash version of a Lifetime ISA and a stocks and shares Lifetime ISA in the same tax year

If you transfer money from another ISA into a Lifetime ISA it counts towards your £4,000 limit

SHOULD YOU INVEST IN CASH OR THE MARKETS?

We will now use the example of a hypothetical couple called Jon and Alice to illustrate the thought process for investing in a Lifetime ISA.

If you are in a similar position to Jon and Alice who are saving for a new home and targeting a purchase within the next three years, you are better off saving in cash.

That’s because the minimum time horizon to consider investing in riskier assets like stocks and funds is at least five years.

People don’t naturally think about it this way, but risk appetite can depend on your time horizon, and the longer it is, the more ‘risk’ you can afford to take. In other words the longer your money is invested the better the odds are that you will successfully ride out the inevitable bumps in the stock market.

Generally speaking economic expansions produce higher profits and stock prices roughly track profits over the long-term.

In contrast, over shorter horizons, stocks can be very volatile which exposes you to the risk that when you need to withdraw your savings the stock market could be experiencing a dip, and you might end up with a lower amount of capital back.

The Help to Buy ISA market is far bigger than the Lifetime ISA market with 27 providers and the best interest rates available at the time of writing is 3% from Penrith Building Society. In comparison, the best rate on Cash Lifetime ISAs is 1.4% from Moneybox.

Stocks & Shares Lifetime ISA providers include AJ Bell Youinvest, Nutmeg and Moneybox.

THREE FUND IDEAS

When saving for longer term projects such as future school fees, it is appropriate to invest in riskier assets like stocks. Given that the horizon is not ultra-long-term, it would still make sense to keep the investments on the ‘safer’ side of the risk spectrum.

Unlike the Help to Buy scheme, Lifetime ISAs permit investments in stocks and shares as well as cash.

If Jon and Alice reassess their timeframe for buying a house to five years’ time, it would still be unwise for them to attempt to pick individual shares until they have built up their knowledge and confidence with investing. It is also important to build a diversified portfolio of shares and this requires a decent chunk of capital.

Given that Jon and Alice are relatively new to investing and have modest amounts to invest, it would be more appropriate to spread the risk by investing in a low cost tracker such as the Fidelity Index World Fund (BJS8SJ3) which is designed to closely match the performance of the MSCI World index.

The fund has over £1bn in assets and gives access to around 85% of the global developed equity market, spread over 1,600 companies. Effectively you are getting exposure to the global economy for a low cost.

If Jon and Alice instead wanted to push the boat out a little they might consider investing in an actively managed diversified fund. The costs would be higher but the potential returns might be greater. One should also bear in mind that the returns could be lower.

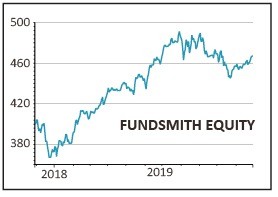

A global fund worth considering is Fundsmith Equity (B41YBW7) which has £19.5bn of assets and invests globally in what the manager considers to be ‘best in class’ large cap companies.

Run by Terry Smith, the fund has a very clear and rigorous investment process which has delivered better returns than the MSCI World index.

Another option worthy of consideration which provides a broadly diversified portfolio is F&C Investment Trust (FCIT), which launched in 1868 and last year raised its dividend for the 48th consecutive year.

Its aim is to generate long-term growth and income by investing primarily in an international portfolio of listed equities. The trust is highly diversified and cautiously managed, with exposure to over 450 individual companies from around the world.

This article was originally published in Shares on 5 December 2019