Another microcap pretender that looks on borrowed time, electronic purchasing platform for enterprise tiddler CloudBuy (CBUY:AIM) still has precious little revenue, huge losses and is fast running out of cash. That it made it through the first six months of 2016 at all is largely thanks to a £5.75 million loan in March, bankrolled by management and major shareholder Roberto Sella, who now owns a 11.3% stake, according to Morningstar data.

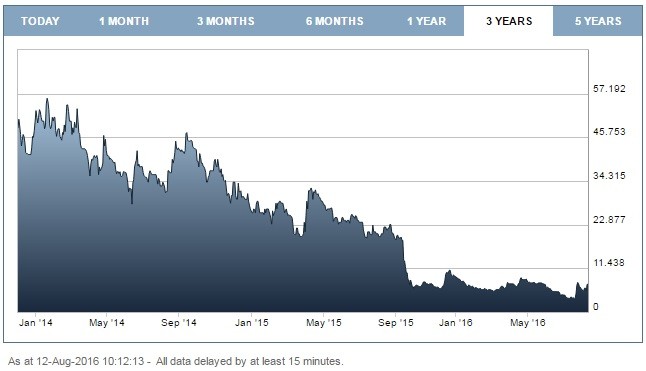

For context, when the firm last raised cash in October 2014 via a share placing, the new funds were raised at 43p a share. As the chart shows, it's been a ride akin to a ski slope black run ever since, the stock today trading at 7.25p.

The half year to 30 June shows another steep fall in already piddling revenues to £785,000, on which it ran up an eye-popping £2.35 million operating loss. And that's a huge improvement on a year ago when operating losses topped £3.16 million on £887,000, mainly down to cost cutting.

Having been ditched by its former nomad Westhouse Securities in September last year, the business has pushed to refocus, concentrating on a handful of key licence-backed accounts, but in the absence of topline growth this looks increasingly like a race to the bottom. On such tiny revenues there is only so much operating flab to be cut away before CloudBuy starts feeding on itself, which may already be happening.

Chewing its way through more than £1.9 million of cash in six months is a worrying data point. That's again marginally better than a year ago but a modest improvement on dreadful isn't really saying much. It's got another £1.9 million left in the bank, so six months or less.

Some new business may come through via seeded prospects during the half but, as TechMarketViews analyst Angela Eager points out, 'these do not guarantee revenue.'

Given that executive chairman and founder Ronald Duncan (14.2%) (pictured) and Sella own roughly a quarter of the business between them, a take private seems the way forward. Amazingly, Katie Potts' Hearld Investment Management is still in (it owns a 3.83% stake) although valued at about £730,000, it's not impossible that the star tech fund manager has simply forgotten all about the stake. Most other investors clearly have.