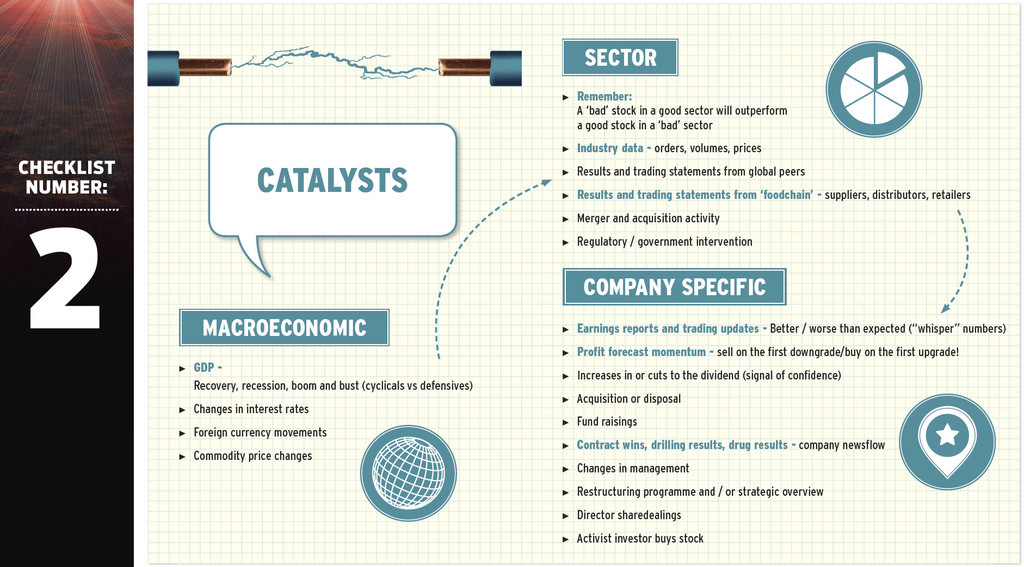

To become a better investor, it is vital to understand the range of catalysts that can move a share price. Understanding the way the market works can give you an edge for buying and selling at the right moment.

Two natural catalysts are the publication of half-year, also known as interim, or full-year results. Yet the figures are historical and give you a snapshot of the past, so the real catalysts are the outlook statement or whether the numbers are better or worse than expected.

(Click on the image to enlarge)

Here is the news

Trading statements are often the triggers for analysts to upgrade or downgrade earnings forecasts. Such events can initiate a share price movement up or down that can last for days, weeks or even months.

The job of the investor is to ascertain whether the good or bad news is fully priced into the stock. If the market fails to spot the importance of a trading update, this can present an ideal opportunity to buy as the market will certainly wake up once the subsequent period?s trading is laid out for all to see.

On the flip side, if the market goes crazy for a stock on the back of a trading update that does not necessarily imply a big change in events, then you may need to be ready to sell into the rally.

Often in the case of a stock that has surged after a positive trading update, it can be better to travel than arrive. If the market has recognised the benefits in the trading update, then a decent performance in the next set of financial results should not theoretically surprise anyone. Market anticipation can have a greater influence on a share price movement than the publication of facts. This is why you often see a share price fall on what would, to the untrained eye, appear to be decent set of numbers. Never, ever forget that financial markets are discounting mechanisms - they always look forward, not back. A published set of results may be of no more value than yesterday?s weather for farmers unless you look for clues about the future.

It is still very important to monitor company news. Contract wins, drilling results for oil, gas or mining companies, drug trial results, technology licence agreements - all these are examples of news that define the future earnings profile of a business.

PAYOUT PLAN

An increase or cut to dividends can be big catalysts. A better-than-expected hike in the shareholder payout is often a strong indication of management?s confidence about their charge?s strategic and financial prospects. A cut either means that business has been poor, so it does not have enough spare cash to pay the previously-expected level of dividend - or there is a particular reason like a big acquisition. For example, Pan African Resources (PAF:AIM) suspended its shareholder payment in 2012 to free up cash so it could buy the Evander gold mine in South Africa. In the absence of an acquisition, a dividend cut generally spells bad news. Just look at RSA (RSA) which fell 21% over two months after it chopped its payout by a third in February.

Management changes can be taken both positively and negatively. Jan Nelson quitting as chief executive officer of Pan African Resources sent the shares down 11% as his leadership skills were seen to be a big asset to the business. News that Carnival?s (CCL) CEO Ted Arison was being replaced after 34 years in the hot seat sent the cruise line operator?s shares up 13% as investors welcomed the arrival of a new broom.

Activist investors buying stock can provide a strong wake-up call to the market there could be value locked up within a firm that is not being run as effectively as it could. These types of investors spend a long time trawling the market for stocks that could be trading below the value of cash in the bank or have a sluggish management team that has failed or not tried to advance the business. Hanover Investors ousted three directors of electronics repair specialist Regenersis (RGS:AIM) in February 2011 and turnaround efforts have since resulted in the share price more than trebling.

Big picture

Sometimes it is not a company specific event that moves a share price. It is very important to keep your eye on broader activity in any sector you like. We believe ?bad? stock in a good sector will generally outperform a good stock in a ?bad? sector. For example, if commodity prices are rising fast, then investors will flock to the mining industry. They will buy any company regardless of whether its assets are any good. But if mining is out of favour, everything is likely to fall in value - even a company which has very low operating costs and stands above the crowd through its ability to make a profit when most of its peers could be loss making.

It is a good idea to try and build a list of overseas-listed companies that are sector peers to UK-quoted stocks, as an announcement from one can move shares in the other. This often happens with caterers Sodexo (SW:PA) and Compass (CPG), for example.

There could be even closer correlation between fellow UK-quoted companies in the same sector. Just look at Ryanair?s (RYA) semi-profit warning earlier this month (4 Sep). That dragged not only its share price down but also those of International Consolidated Airlines (IAG), Dart (DTG) and easyJet (EZJ). A good place to find related companies is on Google Finance. Type a company?s name into the search bar and then scroll down to find related companies.

Economic announcements can change the market?s mood at the flick of a switch. New figures on manufacturing, employment, services and gross domestic product can have a significant impact on equities, bonds and other asset classes including commodity prices. Interest rates also fall into this category.

We publish a list of upcoming results, trading updates and key economic announcements every week in Shares. Keep a diary of forthcoming scheduled announcements and think about how a positive or negative result could impact the shares you are either watching or already own.

This is an edited version of an article first published by Shares in September 2013.