-$320 million acquisition accelerates cancer franchise

-Potential to unlock new ways to fight cancer

-Deal expected to close in first quarter of 2023

Pharma group AstraZeneca (AZN) is acquiring next generation T-cell receptor therapies company Neogene Therapeutics for a total consideration of up to $320 million on a cash and debt free basis.

Investors welcomed the deal with the shares advancing 0.7% to £111.22, closing in on the all-time high of £113.55 reached in August this year and extending year-to-date gains to 31%.

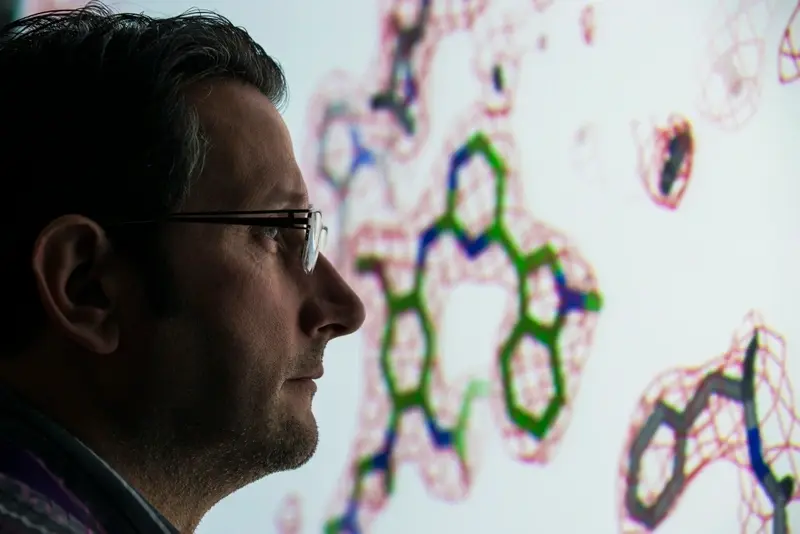

Neogene has developed a novel cell therapy targeting solid cancer tumors. Its expertise is in pioneering the discovery, development, and manufacturing of next generation T-cell receptor therapies (TCR-Ts).

T-cells are part of the immune system and develop from stem cells in the bone marrow. They help protect the body from infection.

NEW WAYS TO FIGHT CANCER

Unlike most current approaches which look to modify the immune system’s T-cells on the surface of cancer cells, TCR-Ts can recognise cancer-specific intracellular mutations. This potentially unlocks previously inaccessible targets.

Executive vice president of oncology (cancer) at AstraZeneca Susan Galbraith commented: ‘This acquisition represents a unique opportunity to bring innovative science and leading experts in T-cell receptor biology and cell therapy manufacturing together with our internal oncology cell therapy team, unlocking new ways to target cancer.

‘Neogene's leading TCR discovery capabilities and extensive manufacturing experience complement the cell therapy capability we have built over the last three years and allow us to accelerate the development of potentially curative cell therapies for the benefit of patients.’

THE DEAL SPECIFICS

AstraZeneca will pay an initial cash consideration of $200 million on closing of the deal and up to a further $120 million in contingent milestone payments.

The company said the acquisition does not impact its 2022 guidance. On completion of the deal Neogene will operate as a wholly owned subsidiary and is expected to close in the first quarter of 2023.

FTSE 250 listed healthcare investor Syncona (SYNC) holds an 8% stake on Neogene. The company said the acquisition will result in upfront initial cash proceeds of £16 million, representing 1.1 times its original cost.

Future milestone payments have the potential to generate a further £6 million of cash, representing 1.6 times original cost, according to the company.

STRONG CANCER FRANCHISE

AstraZeneca has a strong pipeline of cancer drugs in development and on the market. In October 2022 the company announced positive top line results from a phase three trial of a combined treatment of capivasertib and Faslodex.

Capivasertib is an oral investigational treatment for multiple sub-types of breast cancer and prostate cancer.