The decision by Saudi Arabia to enter a price war over oil, amid a coronavirus-linked demand shock, has put the commodity on course for its worst one-day fall since the Gulf War nearly 30 years ago.

The heavy weighting of BP (BP.) and Royal Dutch Shell (RDSB) in the FTSE 100 helped drag the FTSE 100 down to its lowest level in four years and prompted one of the biggest intra-day falls for the index on record.

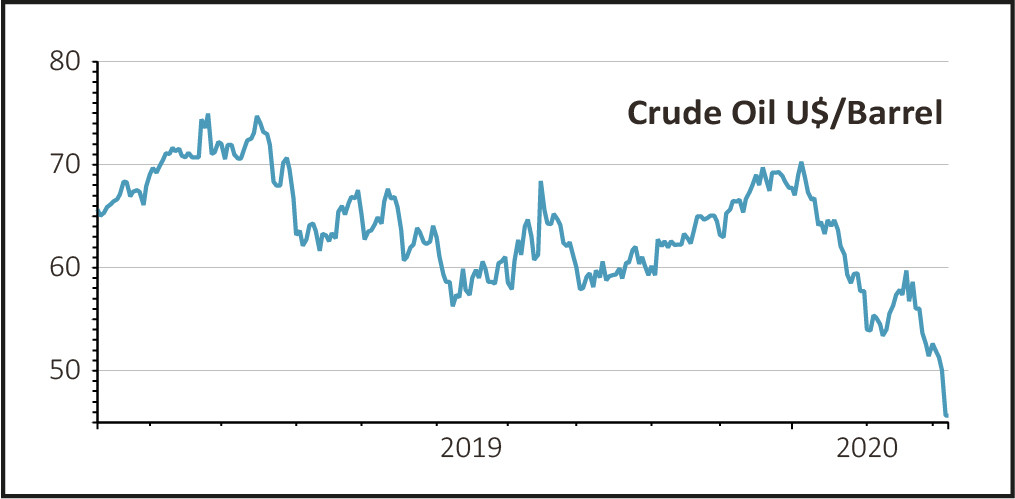

Brent crude is down 20%, having traded as much as 30% lower, and at $36 per barrel is still at its lowest level since early 2016.

A prolonged slump in crude could have particularly severe implications for companies with strained balance sheets.

This explains the particularly big falls in the share prices of Premier Oil (PMO), down 58.5% to 25.6p having traded as low as 10p, and Tullow Oil (TLW), down 37.3%, also falling to a low of 10p.

The Saudi decision to slash prices for its crude and increase output follows Russia’s refusal to back curbs on production proposed by producers’ cartel OPEC on Friday.

AJ Bell investment director Russ Mould says: ‘A previous attempt (by Saudi Arabia) between 2014 and 2016 to grab market share by pushing US shale oil producers out of business was ultimately a failure. The weakest operators in North America were wheedled out and the rest improved the efficiency of their operations and refined their technology.

‘Time will tell if it plays out differently in 2020 but, unless there is a rapid recovery, the collapse in crude is likely to put significant strain on state finances in both Saudi Arabia and Russia, as well as other countries which are major producers of oil.

‘Conversely a falling oil price may provide some respite to consumers of oil amid the coronavirus disruption as it feeds through into lower costs for transport and energy.’