While the UK is in a state of growth, recovering rapidly after amassing its largest deficit in 70 years, uncertainties still abound. The historic ?no? vote in the Scottish referendum on 18 September may have preserved, for now at least, a centuries-old union. Yet UK currency and credit markets have been rattled and the fact the historic union came so close to splintering has hardly made investment in the UK more appealing.

Tellingly, there is evidence of investment funds shifting money overseas - (see Opinion, Shares, 18 Sep) - with CrossBorder Capital having recently said the net flow of capital out of Britain reached £16.8 billion in August, the highest level since the financial crisis in 2008. Meanwhile, despite improving macro data in the UK, the looming prospect of a rising interest rate environment after years of cheap money suggests visibility for UK-focused investors could become increasingly clouded.

Overseas comforts

Thankfully, investors skittish about the UK can seek comfort via funds tapping into overseas opportunities, de-risking and diversifying portfolios by going global. Overseas funds offer facilitated exposure to the economic prospects of attractive foreign markets, as well as differing interest rate profiles, currencies and political climates away from UK shores.

One of the most effective ways to do so is via investment trusts, the oldest form of collective investment scheme whose origins can be traced back to 1868. Going global via an investment trust enables the self-directed investor to gain exposure to stocks and markets they?d be less able to access themselves, via the underlying assets of the portfolio, as well as the skill of the professional money management team, helping them access key international investment themes and spread risk in a cost-effective manner to boot.

As at 31 August, investment company industry body the Association of Investment Companies (AIC) had 352 members with a bumper £106.3 billion in total assets, while the wider industry sports 399 companies with almost £118.3 billion in total assets. The AIC classifies its members by sectors based on investment objective and also industry and regional focus. Investors looking to go global should first examine constituents of the AIC Global, Global Emerging Markets, Global Equity Income, Global High Income and Global Smaller Companies sectors. However, they can also access region-specific sectors spanning Asia Pacific, Europe, Latin and North America, not to mention the trade body?s Country Specialists sector classifications.

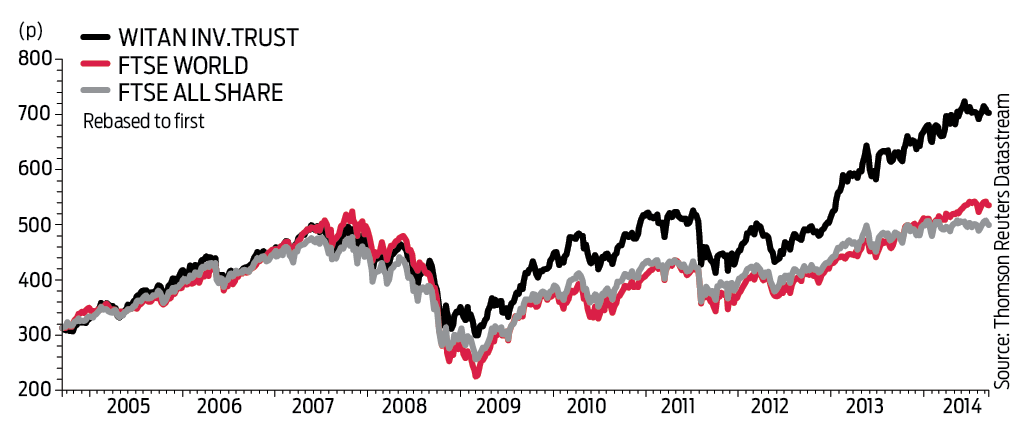

Moreover, the investment company ranks include firms with proven pedigree, which have been in existence for a hundred years and more. They include the likes of Witan Investment Trust (WTAN), a multi-manager behemoth seeking long-term capital growth and dividends through global equities, as well as Bankers Investment Trust (BNKR), a diversified international portfolio with £700 million in total assets. Another familiar name is Alliance Trust (ATST), a £2.5 billion cap self-managed investment company whose holdings range from Walt Disney (DIS:NYSE) to Wells Fargo (WFC:NYSE), while the Allianz Technology Trust (ATT) brings investors access to some of the hottest global tech themes under Walter Price?s proven stewardship.

(Click on chart to enlarge)

Going global

The increasing allure of going global is underscored by recent developments at the first ever investment trust, Foreign & Colonial (FRCL). Launched back in 1868, the diversified portfolio gives investors exposure to most of the world markets, with the trust invested in more than 600 companies in 35 countries. Significantly, Paul Niven, the new manager of the trust, run successfully for 17 years by Jeremy Tigue, has been cutting the UK exposure and looking overseas for opportunities.

?Foreign & Colonial Investment Trust has adopted a more global approach in our search for investment opportunities and this has led to our allocation to UK equities declining from a level of almost 35% at the start of 2013 closer to 10% today,? he explains. ?The historic allocation bias to our home market of the UK is, in our view, no longer appropriate for the investor who is seeking the best possible returns from across the globe. Clearly, UK equities provide significant global exposure as underlying revenues are approximately 75% sourced from outside of the UK and our home market contains many market leading global companies across a number of sectors. Nonetheless, the UK equity market is highly concentrated with the top 10 stocks accounting for around 40% of large cap exposure. In addition, it is underexposed to a number of attractive sectoral opportunities, notably technology stocks. In our view, broadening the opportunity set, and managing risk exposures across the portfolio, taking account of market and currency factors, as well as sectoral and security considerations, will lead to a superior outturn for our shareholders.?

Get an edge

Belonging to a broader church of funds that includes unit trusts, open-ended investment companies (oeics) and exchange-traded funds, investment trusts are listed on the London Stock Exchange and you can buy and sell their shares as you would in any other quoted firm. By buying shares in these investment companies, which invest in a diversified pool of assets, you can spread your risk and access global opportunities you probably wouldn?t or couldn?t find on your own.

When it comes to investing in global assets, investment trusts have a number of key strengths worth noting. Simon White, head of investment trusts at BlackRock, says ?investment trusts are a great way for private investors to access global markets, and were first set up to do this almost 150 years ago. Through the purchase of one security you can acquire a ready-made, professionally-managed portfolio, with a global, regional, individual country or global sector.?

Investment trusts have a ?closed-ended? structure, meaning there is a fixed number of shares in issue, so for every buyer there has to be a seller. This structure can be an advantage for a global portfolio manager, freed up from dealing with the expansion and contraction in fund size, depending on fund inflows and outflows, that occurs in the open-ended sector. This gives them greater flexibility and enables them to adopt a long-term view, as they don?t have to worry about selling good stock to meet redemptions during bear market conditions and don?t have to deal with unwelcome flows of money during bull market runs either, times when equity valuations tend to become frothy.

BlackRock?s White argues that ?investment trusts are well suited to emerging markets as having a fixed number of shares in issue means fund managers can make investments for the medium and long term. BlackRock Frontiers (BRFI) and BlackRock Emerging Europe (BEEP) have fixed dates (2016 and 2018) when investors can elect to realise their investment at asset value for cash for instance.?

Rather than being inextricably linked to the value of the underlying portfolio, share prices of investment trusts are driven by the market. Hence if demand for an investment trust is high, their shares may trade at a premium to their net asset value (NAV), but if demand is low, the shares are likely to trade at a discount. You can quickly find out which by visiting the AIC website - www.theaic.co.uk/aic/compare-investment-companies. While this quirk can create an element of volatility, it also means there is an opportunity for value-hungry investors. Since many investment trusts trade at a discount to the value of their underlying assets - currently the case with a number of names within the AIC?s global sectors at the time of writing - you can hypothetically pay 80p for a share worth £1. In order to realise this value, the discount has to narrow from the level at which you buy and there is a risk it could widen out further.

Trusts also have an ability to introduce debt to their portfolios, a feature that sets them apart from open-ended counterparts facing restrictions on gearing. Simon White explains: ?Investment trusts have the ability to borrow, including in foreign currency to match their underlying assets, to enhance returns.? This freedom to borrow or ?gear? in order to enhance returns enables managers to magnify their returns in rising overseas markets should they wish, though of course if markets turn bearish and performance poor, losses will be magnified. Alan Porter, manager of Securities Trust of Scotland (STS), makes the point that in the current low interest rate environment, gearing is a great way for global investment trust managers to enhance dividend income by borrowing money cheaply and investing in equities with attractive yields.

Investors putting money to work in globally-focused trusts might also draw comfort from their independent boards of directors. A top-notch board can add value for investors by taking steps to protect shareholders? money, ensuring the portfolio manager is sticking to the stated objective and doing a good job, while generally providing a good level of oversight which is important given the risks associated with investing overseas. Generally speaking, the majority of investment trust directors will also own a stake in the fund they oversee, giving them ?skin in the game? and aligning their interests with other investors.

Income appeal

Income is one of the obvious themes for investors seeking to put money to work via investment trusts, a cost-effective way to facilitate investment in global equities. With interest rates mired at record lows in the UK, US and across European nations, investors need to put their money to work in order to eke out any meaningful yield. Investment trusts are at a structural advantage compared to other types of collective, as they can stash away up to 15% of their income each year in their revenue reserves and have the option to employ gearing too. The advantages of this is they ensure they can still pay and importantly raise dividends during tougher periods, a process known as ?dividend smoothing?. Revenue reserves can also help smooth dividend payouts which would otherwise be more volatile because of currency moves.

Dividend-hungry long-term savers seeking diversification away from the London market?s well-known income-yielding stalwarts can look to the likes of the Henderson International Income Trust (HINT) (see Shares, Funds, 11 Sep) for solutions. The only international income investment trust that invests exclusively outside the UK, the portfolio is run by dividend-seeking, valuation-driven portfolio manager Ben Lofthouse and with £92 million in total assets under management at last count, trades at a 6.6% discount to net asset value that should attract value seekers. A 3.6% dividend yield, potential for improved payout ratios across portfolio constituents and prospects for some capital growth, suggest it is one for growth and income seekers alike.

Shares remains enthusiastic about the Securities Trust of Scotland (see Funds, Shares, 10 Apr). Despite its name, the investment trust?s objective is to provide a rising income and long-term capital growth through a focused portfolio of between 40 and 60 global equities. Holdings range from consumer products powerhouse Procter & Gamble (PG:NYSE) to Australian rail-freight operator Aurizon Holdings (AZJ:ASX) and recent portfolio addition Meggitt (MGGT) .

?Going global gives you extra choice in regions, sectors and countries you can invest in,? says Porter, a fervent supporter of seeking income and capital growth opportunities overseas, adding ?and it gives you greater income diversity than single-country funds.? He argues that by searching beyond the UK?s shores, investors can avoid the risk of income concentration. ?If you have a single country strategy, you might find a relatively small number of stocks provide a disproportionately large amount of your dividends in the country you are invested in,? explains Porter. ?And you might almost be compelled to own a stock because it is 5%, 6% or 7% of your benchmark.?

The canny manager also stresses a further advantage of investment trusts when seeking to profit internationally, namely the stable asset base the closed-ended structure brings. This ensures managers don?t have to worry about managing the differing dividend dates and payout schedules companies around the world inevitably have, an irksome consideration for unit trust and oeic managers when monies are flowing in or out of their funds.

Prime performers

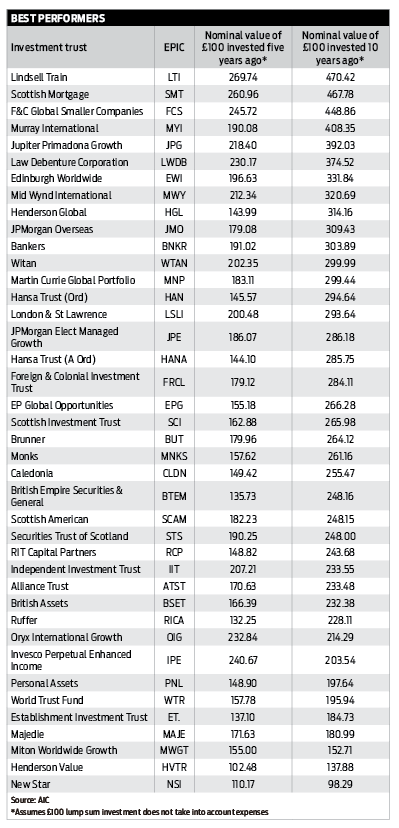

Investors seeking to profit from global trusts will find the tables provided (see table) extremely useful. These show the best performers from the Global Growth, Global Income and Global Smaller Companies sectors over five and 10 years, periods sufficiently long enough to gauge consistent performance.

Among those with exceptionally strong track records are the likes of Lindsell Train (LTI). The trust is managed by respected stock picker Nick Train, who has a fondness for consumer staples with globally resonant brands, pricing power and scope for progressive dividend payouts such as Heineken (HEIA:NA), Diageo (DGE) and Unilever (ULVR). Under his stewardship, the company has generated share price total returns of 169.7% and 370.4% over five and 10 years respectively.

Other consistent performers include Scottish Mortgage (SMT), the Baillie Gifford-managed trust with a 367.8% 10-year total share price return haul and holdings ranging from Chinese search engine Baidu (BIDU:NDQ) to billionaire Elon Musk?s electric car maker Tesla Motors (TSLA:NDQ).

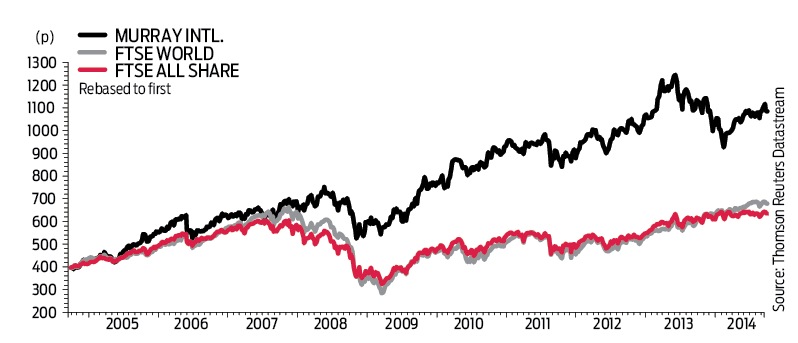

(Click on chart to enlarge)

Well worth putting on any investment trust watchlist is Murray International (MYI) from the Aberdeen Asset Management (ADN) stable. Indefatigable manager Bruce Stout has generated strong total return over a consistent time frame, with share price total return up 308.4% on a decade long view. Also with stellar long-term track records are the likes of the aforementioned Bankers and F&C Global Smaller Companies (FCS).

(Click on table to enlarge)

Walk tall

Shares remains enthusiastic about the Tom Walker-managed Martin Currie Global Portfolio Trust (MNP), whose objective is to generate long-term capital growth ahead of the FTSE World Index by investing in a diversified portfolio of around 60 internationally-quoted companies.

Edinburgh-based Walker has a focus on the proven long-term value drivers behind share price movements which chime with our own preference for quality, value and growth. A stockpicker with 26 years of investment experience, Walker?s fund has 58 holdings spanning 17 countries according to the latest factsheet, ranging from the likes of JP Morgan Chase (JPM:NYSE) to iPhone giant Apple (AAPL:NDQ).

Strong recent portfolio performers include US tech giant Apple as well as chemicals maker LyondellBasell Industries (LYB:NYSE). The latter is a structural winner benefiting from the US shale boom and cheap prices for ethane, its primary feedstock. This is enabling the group to generate wider margins on lower prices for ethane and Walker says the company is ?generating cash hand over fist?.

Uncle Sam opportunity

Oriel Securities? well-followed investment trust analyst Iain Scouller highlights a widening in discounts over the past month on a number of investment trust sectors, with one factor being the weakness of Sterling against the US dollar.

Writes Scouller: ?We think this significant foreign exchange move is one factor in the widening of discounts seen on the trusts investing in the US, with the North American sector seeing the average discount of 0.9% at the end of June, widen out to 2.3% by mid-September. The discount widening on US smaller company trusts has been even more marked, with the average discount widening from 10.3% to 14.6% over the same 10 week period. This widening of discounts may present some opportunities for value investors.?

One trust trading on a 6.4% discount at the time of writing, is North American Income Trust (NAIT). Managed by Paul Atkinson, it seeks to generate above average dividend income and long-term capital growth through investments predominantly in S&P 500 constituents.

Alex Crooke,

manager of Bankers Investment Trust

?Investment Trusts have a long history, with many dating back to the late 1800?s but what is often overlooked is how investing globally has been the key to their longevity,? says Alex Crooke, manager of Bankers.

The UK stock market today contains only five large banks, two major oil producers and two global pharmaceutical companies. Are they the best positioned companies in these sectors? Beyond our shores an investment manager can find companies with better growth prospects both in terms of income and profits. For example, US banks are enjoying much better loan growth compared to UK banks, which should flow through to their dividends in time.

The structure of an investment trust has added benefits for investors looking to invest overseas. Trusts have the ability to borrow in overseas currencies which can reduce currency volatility and allow access to lower interest rates in places like Japan. Also the long term nature of Trusts plays well when negotiating access to trade in certain markets. Bankers Investment Trust has a quota to invest in local Chinese ?A? Share markets which is only granted to bigger investors with a long term approach to their investment horizon, which the Chinese authorities are trying to attract to their markets.

The challenge for the investment manager is balancing the opportunities with the additional risks. Evaluating and minimising political risk overseas, poor accounting standards or corporate governance requires careful study but in my opinion the greater opportunities far outweigh the extra risks.?

Annabel Brodie-Smith,

communications director, AIC

?The Global and Global Equity Income sectors house some of the largest and best loved investment companies, many of which have been serving shareholders for decades, through two world wars, political conflicts and economic booms and busts,? says Annabel Brodie Smith. ?But they also cover a broad spectrum of investment strategies, including fund of funds, multi manager, and a few have a focus on capital preservation. Some are punchier than others, for example some might have a higher than average exposure to technology, or a particular geographic sector, so investors need to look at the portfolios individually to find the fund that is best suited to their needs. In an uncertain world, they can be a very useful ?one stop shop?, spreading risk across the globe and across sectors as well as countries.?

Brodie Smith continues: ?Some of these companies have enviable dividend track records and have been able to raise their dividend each year for decades, offering an element of comfort for investors in an uncertain world. Other global sectors that spread risk globally include the Global Smaller Companies and Global High Income sectors, so there is good choice for investors looking to spread their risk internationally.?