Housebuilders, office block developers and bridge makers take a beating on the stock market following the worst UK construction data for seven years.

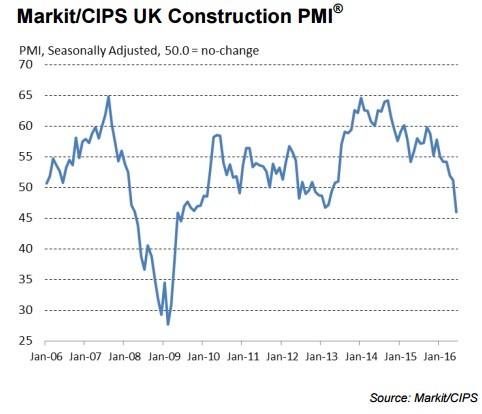

Markit/CIPS’ PMI data for June shows the sector has gone into contraction with a reading of 46. Anything above 50 represents growth.

The latest data puts UK PMI construction activity below the 50 neutral position for the first time since April 2013. June's figure represents a considerable decline from May 2016’s reading of 51.2.

Respondents say the downturn in business activity is due to uncertainty prior to the EU referendum, which also contributed to fewer invitations to tender in the sharpest drop in new business since December 2012.

HOUSEBUILDERS

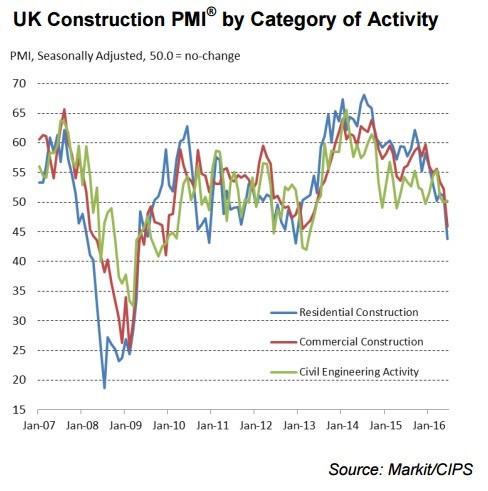

Housebuilding was singled out as the worst hit area of the broader construction industry. The news adds to share price weakness already strangling the sector following the Brexit vote result on 24 June. There is widespread fear the UK property market will go into decline.

Today’s news has a profound negative effect on many stocks popular with retail investors including:

Taylor Wimpey (TW.) - 4% to 131.7pBarratt Developments (BDEV) -5% to 394.2pBerkeley (BKG) -5.6% to £25.09Markit senior economist Tim Moore comments: ‘Housebuilding activity was worst affected by the uncertain business climate in June, very closely followed by commercial work.’

COMMERCIAL BUILDERS

Commercial work declined for the first time in over three years, says Markit. There is a fear that corporates will delay or cancel any office expansion plans - or even relocate to a different country.

Lower levels of activity in the June PMI data are linked to deteriorating order books and a lack of new work to replace completed projects. Here are three examples of stocks reacting to today’s news:

British Land (BLND) -8.4% to 557.5pLand Securities (LAND) -6.6% to 971.5pLondonmetric Property (LMP) -1.5% to 149.5pChartered Institute of Procurement & Supply CEO David Noble says: ‘Commercial building was a close second showing a similarly disappointing result, with a drop in activity not seen since February 2013.’

CIVIL ENGINEERING

Unlike the other sub-sectors, civil engineering activity remained broadly stable in June.

Moore at Markit says: ‘Civil engineering was the only stabilising influence, which underlines the need to shore up decision making on infrastructure projects and help offset any further loss of momentum across the wider construction sector.’

His reassuring tone doesn’t stop investors worrying about the near term outlook for the construction industry with shares also weak among the civil engineers.

Kier (KIE) -4% to £10.08Costain (COST) -1.3% to 313pKeller (KLR) -2.7% to 880pOverall, the rate of contraction is much slower than the 2008/2009 downturn. ‘But, with business confidence at a three-year low, and purchasing activity at its lowest level for six and a half years, this is likely to offer little comfort,’ concludes Noble at CIPS.