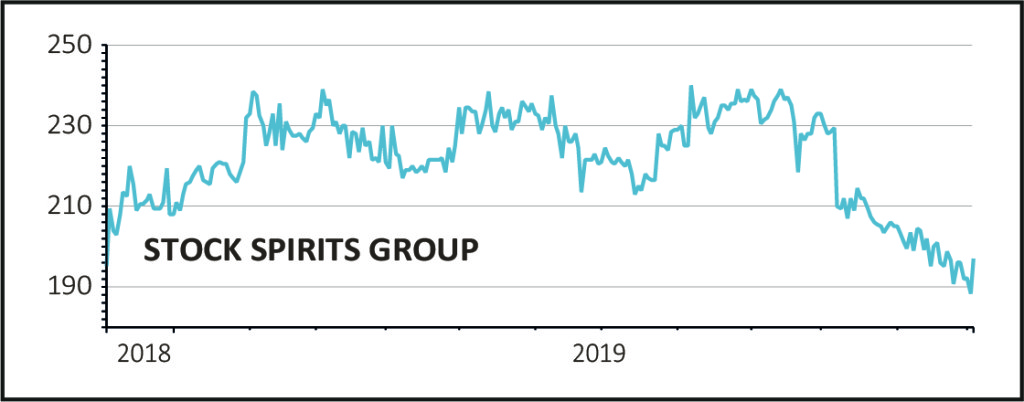

Shares in Stock Spirits (STCK) rallied 5.8% to 199.4p on Wednesday after the Central and Eastern Europe-focused drinks group served up strong full year results.

These demonstrated positive momentum in its core markets of Poland, where the business has been successfully turned around, and the Czech Republic, while investors also welcomed growing confidence that the branded spirits-to-liqueurs leader’s Italian business has stabilised.

POLISH TURNAROUND COMPLETE

Guided by Mirek Stachowicz, the London stock market’s sole Polish chief executive (CEO), Stock Spirits produces premium branded spirits and liqueurs that are mainly sold in Central and Eastern Europe as well as Italy, although the company also exports to more than 50 countries globally.

Flagship brand Zo??dkowa Gorzka was created back in 1950.

Today’s results for the year to September from the vodka, whisky, brandy and rum producer revealed 8% volume growth to 14.4m cases. Revenues were up 10.6% to a better than expected €312.4m, reflecting organic growth and acquisitions, sending pre-tax profit 25% higher to more than €38m.

‘We have delivered a year of good growth as our successful strategy of premiumisation continues to make progress,’ Stachowicz informed Shares. He explained that his charge has also exceeded its strategic premiumisation target of having 30% of group revenue coming from premium products a year ahead of plan.

Furthermore, he enthused that ‘the turnaround of our Polish business is complete, and we have now delivered 29 consecutive months of year-on-year volume share growth in that market. We have also strengthened our leadership position in the Czech Republic, taking market share in volume and value.’

PROFITING FROM THE PREMIUMISATION

Poland is in fact the world’s largest third vodka market by value and last year, Stock Spirits outperformed the total vodka market with a tailwind from growing consumer confidence and purchasing power. Stock Prestige, the number one premium brand in Poland, spearheaded the company’s market share growth.

Underscoring management’s confidence in future prospects, Stock Spirits announced a fresh €25m investment in Poland, where the global trend towards spirits premiumisation is clearly visible, to increase distillation capacity.

READ MORE ABOUT STOCK SPIRITS HERE

Away from Poland, Stock Spirits delivered a strong performance in the Czech Republic, where the economy is performing well.

Performance also improved as the year progressed in Italy, where the highly fragmented total spirits market grew in both value and volume terms thanks to recovering consumer confidence.

Numis Securities has a ‘buy’ rating and 330p price target for progressive dividend payer Stock Spirits, implying 65% potential upside at current lowly levels.

‘The strong momentum in the business is tempered by the uncertainty created by potential excise increases,’ cautioned the broker, ‘resulting in a circa 3% increase to adjusted earnings per share for the forecast period.’

Numis also explained that Stock Spirits’ two recent acquisitions - Distillerie Franciacorta, a leading grappa, spirits and wine business in Italy and Bartida, a high-end on-trade spirits business in the Czech Republic - are ‘delivering to plan’.