High-flying Scottish Mortgage (SMT) may have reached its limits given the FTSE 100-listed investment trust’s ‘exceptional performance’ throughout the coronavirus pandemic.

So argues Stifel, which sees ‘a good case to take some profits and lock in some gains’ after identifying a number of potential negative catalysts ahead for the retail investor favourite.

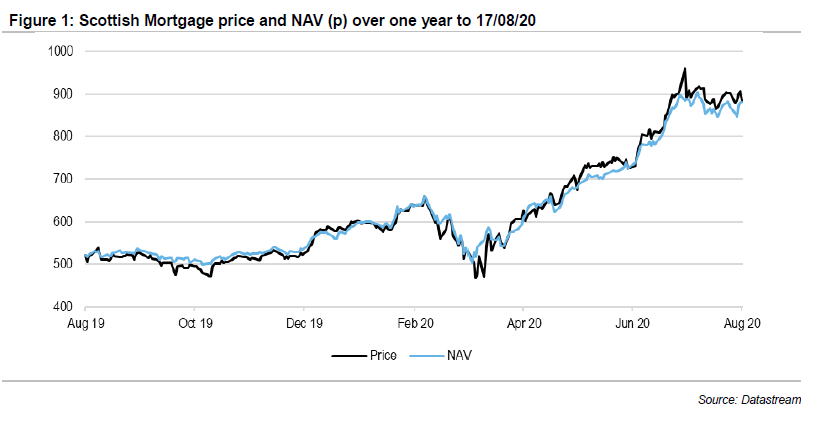

Stifel’s analysts point out Scottish Mortgage’s share price and net asset value (NAV) have performed strongly both in the long and short term and they still regard the Baillie Gifford-managed investment trust as a ‘core holding’.

Yet Stifel believes that given the ‘exceptional performance with the price rising by 55% since the start of this year and almost doubling from a low of 468p on 18 March, we do think there is a good case to take some profits and lock in some gains’.

Stifel’s analysts also explained that in their experience, investment trust net asset values (NAV) and share prices ‘don’t rise in a straight line indefinitely’.

Scottish Mortgage’s co-managers James Anderson and Tom Slater identify companies, enabled by technology, which they believe have the potential to be much greater in size in the future thanks to having a proposition which is scalable and could be market-leading in time.

They will hold on to these investments once investee companies become market leaders, thereby turbo-charging returns for shareholders.

This strategy has paid off handsomely both long term and short term. Scottish Mortgage has put in a barnstorming performance during the pandemic and economic shutdown thanks to its focus on rapidly-growing disrupters of traditional business models and tech companies.

The trust has also benefited from a relatively high weighting in Chinese-domiciled companies whose valuations have proved relatively robust in recent months, despite the fact that Covid-19 originated in China.

Scottish Mortgage’s recent standout performers include Elon Musk-steered electric vehicles company Tesla and Jeff Bezos-bossed tech giant Amazon.

China’s Tencent and Alibaba have also performed well since the start of this year and managers Anderson and Slater appear to have been trimming some of these large positions as their prices have risen.

HIGH CONCENTRATION RISK

In today’s note, Stifel highlights the potential downside from Scottish Mortgage’s highly concentrated portfolio, with the ten biggest investments accounting for 58% of NAV at the end of June, indicating ‘a relatively high degree of company specific risk’.

Over recent months, this concentration has worked well for investors given the very strong price performance of many of Scottish Mortgage’s largest investments.

But ‘in a different market scenario, or if there were some negative company specific issues, the concentration could be an important risk factor, potentially impacting performance,’ warned Stifel.

NEGATIVE CATALYSTS

Stifel also outlines a number of scenarios that could negatively impact Scottish Mortgage, a trust with a growing exposure to unlisted companies including mobile payments company and IPO hopeful Ant, a topic Shares addressed here in July.

These scenarios include a potential rotation away from growth stocks to value stocks, and a change in US policies on technology companies should Joe Biden and the Democrats win the US election in November.

‘Taking into account the gains that have been made and the increased weighting many portfolios will have in Scottish Mortgage shares following their relative outperformance, compared to other equities, we believe that banking some profits could be a contrarian but prudent course of action,’ says Stifel.

Even before the pandemic, Scottish Mortgage had put up spectacular numbers, according to Stifel. The trust delivered a 361% net asset value total return in the ten years to March 2020, almost triple the return from the FTSE World Index over the same period.