- Revenues and earnings better than forecast

- Stock up 3%, continuing strong recent run

- CEO Tan stays deliberately vague on guidance

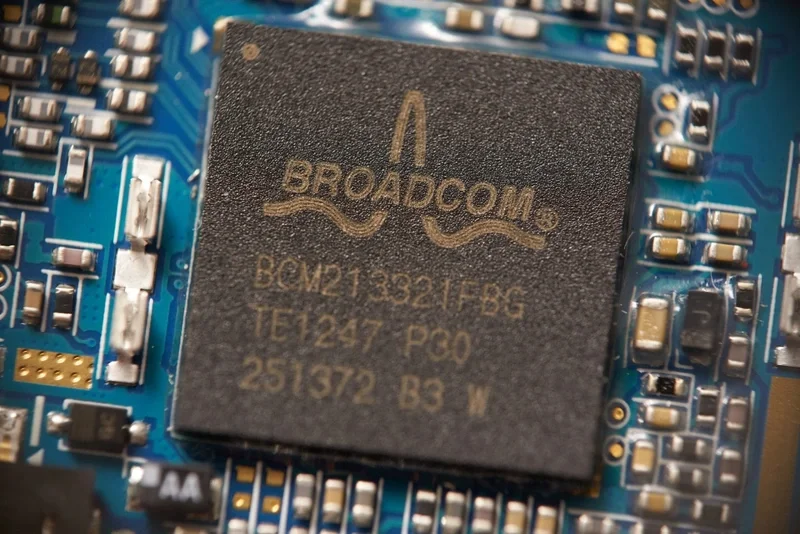

Semiconductors bellwether Broadcom (AVGO:NASDAQ) beat the street in its latest quarter (to 31 Oct), but management remains very cagey about the year ahead.

The San Jose-based microchip firm reported fiscal fourth-quarter net income of $3.31 billion, or $7.83 a share, compared with $1.91 billion, or $4.45 a share a year ago. Adjusted earnings, which exclude stock-based compensation and other items, were $10.45 a share, compared with $7.81 a share in 2021.

Revenue rose to $8.93 billion from $7.41 billion, year-on-year, as chip sales rose 26% to $7.09 billion and infrastructure software sales increased 4% to $1.84 billion.

Analysts had forecasted adjusted earnings per share of $10.28 on $8.9 billion revenues.

WHY BROADCOM MATTERS

Broadcom provides a range of semiconductor and infrastructure software applications that provide the platform on which much of the world’s digital applications and services are built. Things like data centres for cloud computing, networking, software-as-a-service solutions, broadband, wireless connectivity, and data storage.

Think about many of the everyday tech bits and pieces that touch the average consumer’s life - buying stuff on Amazon (AMZN:NASDAQ), watching a movie on Netflix (NFLX:NASDAQ) or looking up the capital of Kazakhstan on Google (Astana, incidentally), and Broadcom chips will almost certainly be empowering the process somewhere along the line.

It is the 28th largest company on the S&P 500, worth about $225 billion, making it the index's second biggest chip company, behind Nvidia (NVDA:NASDAQ).

LIMITED GUIDANCE

But analysts were left frustrated by Broadcom’s caginess over guidance. The company forecast revenue of about $8.9 billion for Q1 2024 (to 31 Jan), a 15% increase from a year ago, but gave little else away.

Analyst consensus is currently pitched at $8.83 billion, according to Investing.com data, implying $10.17 a share of earnings.

‘Our year forecast will grow,’ said Hock Tan, Broadcom’s chief executive on a call with analysts. ‘We’re really booked.’ But that was about it, other than Tan stating Broadcom hasn’t changed its focus on ensuring that we do not ship products to the wrong people who just put it on the shelves.

Tan refused to tell analysts how fast it is going through its backlog, either, a proof point of how uncertain demand will be in 2023.

On providing a yearly forecast, Tan refused to give in, repeating that the year would ‘grow.’

‘Other than that, I’m not telling you what it is,’ he said. Like last quarter, Tan defended his positive, but vague, outlook and said that end-market demand was solid.

Broadcom shares are set to open more than 3% up when trading restarts on Wall Street later today, at around $548. Just six weeks ago the stock was changing hands 22% lower at $427. The company is currently seeking approval for its $61 billion acquisition of cloud computing firm VMware (VMW:NYSE).