Today's profit warning really is a bolt from the blue. Software escrow and cyber security consultancy NCC (NCC) has lost three major contracts within its Assurance division, pretty much the Accumuli business bought in 2015. There's also delays in signing government contracts at its Fox-IT arm, and this all comes with a hefty hit.

'We expect these issues will have a significant impact on half year margins,' says CanaccordGenuity analyst Daud Khan.

This is the really ominous bit. 'The company believes they can recover in the second half. We believe this will be challenging given the expectation of group margins improving this year,' states Khan.

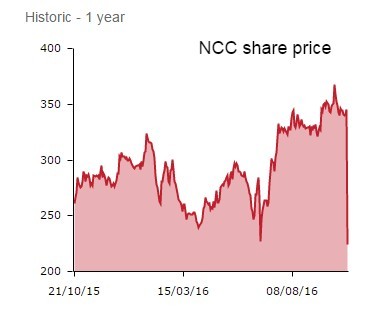

The market clearly shares this bleaker view, the share price collapsing by 35% to 224.4p, their lowest in about 15-months.

At the headline level there is positive progress. A 36% jump in revenues for the four months to 30 September is good, that 21% of that growth is organic is excellent. But NCC appears to be struggling to integrate lumpy product revenues and a large contract deferral relating to government relationships into the wider company.

'This seems like a case of acquisition indigestion for NCC, which has been exercising a rather rigorous M&A schedule over the last 18 months,' says Indraneel Arampatta, analyst at IT consultancy boutisque Megabuyte.

The company seems undeterred, with the recent acquisition of PSC and comments by CEO Rob Cotton about expected further acquisitions of boutique cyber security consultancies (note the plural) over the next few months. The industry backcloth could barely be better.

Management has also re-iterated guidance for the full year, which seems rather unwise. Better to re-base expectations to a level the company is capable of comfortably beating, effectively storing up a good news event down the line. The stock slump today implies that this is what the market is thinking anyway.