Rare diseases specialist Shire (SHP) has impressed investors with its quick out of the blocks starts for XIIDRA. It is a treatment for dry eye disease and the product has managed to capture a 19% US market share in just four months since its debut.

That news got investors interested, driving the share price 2.8% to £47.18.

Shire reported a headline 78% jump in sales to approximately $10.9bn, although that was largely thanks to the Baxalta acquisition in June 2016. Excluding products from Baxalta, the company still delivered pretty impressive underlying sales growth of 15%.

Net income was reported at $327m, 75% ahead, although the company failed to give an underlying figure. Interestingly, organic earnings growth of 11% was reported.

Shire's haemophilia franchise remains a sore spot, with sales under pressure due to competition from Swiss rival Roche’s ACE190 treatment. That led to minimal sales growth of just 1% from the division to $2.8bn. Management blames the timing of large orders for disappointing growth.

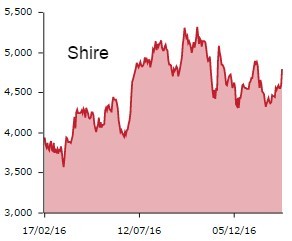

Shire's share price performance has been hit and miss since announcing its intention to spend $32bn on Baxalta, despite its strong position in a potential $14bn plasma products market.

Earlier this month, Shares explained why the stock is trading so cheaply.