Shares in gambling companies are rising after the outcome from the Gambling Commission’s review into fixed-odd betting terminals (FOBTs) was not as bad as expected.

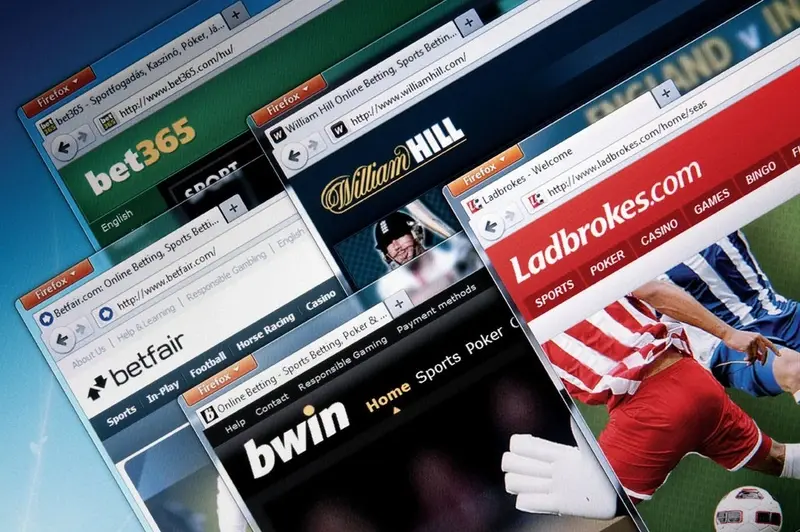

William Hill (WMH) rose 4.2% to 334p and Ladbrokes Coral (LCL) gained 3.2% to 176p.

FOBTs are a key source of income for bookmakers. They allow people to play computer simulated races and casino games, but have recently come under scrutiny.

Critics argue these games can lead to potentially dangerous losses for problem gamblers. Players can currently bet up to £100 every 20 seconds on these machines.

The commission now says stakes for FOBTs should be cut to £30 or below. That’s a better result for the industry which had been braced for a worst case scenario of £2 maximum bet.

Analysts had previously speculated that a maximum £2 stake could have reduced earnings for William Hill and Ladbrokes by as much as 28%.

£2 STAKE CAP FOR SLOT GAMES

Under the proposals by the Gambling Commission, slot games have been targeted with a maximum stake of £2.

‘Our analysis shows that, compared with non-slots players, slots players experience a greater proportion of significant losses,’ comments the Gambling Commission.

Gambling firms still need to be wary of increased regulation via more effective restrictions on gambling and limiting bigger prizes to avoid encouraging dangerous risks.

Other risks for the sector are the potential increase in the UK point of consumption tax rate from 15% to 20%.