Is Sainsbury’s (SBRY) bold takeover of Argos proving to be an inspired move? The answer may well be yes, if the supermarket giant’s first quarter trading update is any guide.

Combining Argos and Sainsbury’s trading data for the first time, like-for-like sales (excluding fuel) rose 2.3% over the sixteen weeks to 1 July.

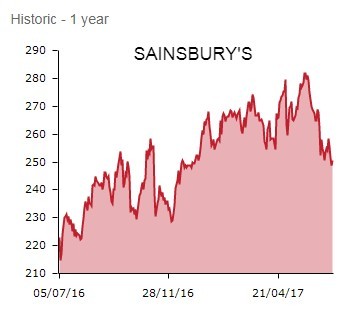

This is not only ahead of expectations, but also marks a significant improvement on the subdued 0.3% growth generated in the preceding quarter. Shares in Sainsbury’s tick 2.5p higher to 251.4p on the news.

Admittedly, it is tricky to decipher how the core supermarkets are performing. With Argos now in-tow, grocery like-for-like sales are now a thing of the past for the UK’s second biggest supermarkets chain.

POSITIVE TREND

Chief executive Mike Coupe, the architect of the Argos buyout, says grocery sales were up 3% and transactions up 2% in the quarter, inflation no doubt playing a part, with ’like-for-like transaction growth in all channels’ and new summer eating ranges flying off the shelves.

‘General Merchandise and Clothing, including Argos, outperformed the market, with Fast Track delivery and collection seeing a stellar performance during the quarter, particularly during the period of warm weather when customers wanted to buy and receive their products the same day,’ says Coupe, who has staked his reputation on the Argos deal succeeding.

‘Argos customers are increasingly choosing to shop with us online, consistent with our objective of being a leading digital retailer,’ he continues.

There are now 75 Argos Digital stores within Sainsbury’s supermarkets and there will be 175 in its supermarkets by the end of the financial year. Coupe remains confident in delivering £160m of cost savings from the Argos acquisition by March 2019.

During the quarter, the heatwave stoked bumper online orders for fans and paddling pools, ordered for same day delivery via the Argos Fast Track service.

Sainsbury CEO, Mike Coupe

LAZARUS MOMENT?

John Ibbotson, director of retail consultancy Retail Vision, sees the update as ‘little short of a Lazarus moment. No longer leaning precariously on the Argos crutch, the Sainsbury’s core business is back on its feet and growing food sales at a healthy clip.

These results are the first to blur the progress of the two brands since last year’s acquisition - but Sainsbury’s no longer needs to hide behind Argos’s success. The 3% growth in grocery sales is an impressive return to form for a brand which for years had dodged the bloodletting unleashed at the cheaper end of the market by the arrival of the discounters. With the Argos brand continuing to fire on all cylinders, Mike Coupe’s acquisition gamble is looking more inspired by the day.’

BUYER BEWARE

While today’s update is heartening for Sainsbury’s shareholders, the competitive landscape is increasingly tough and uncertain. Weaker sterling is driving up the cost of imported foods and eating into consumers’ disposable incomes, while German insurgents Aldi and Lidl continue to take market share, according to the latest Kantar Worldpanel data.

Furthermore, online titan Amazon’s £10.8bn purchase of Whole Foods continues to send shockwaves through the entire retail sector. Sainsbury’s is reportedly in talks to buy convenience chain NISA, in part a defensive reaction to Tesco’s (TSCO) planned merger with Booker (BOK) and the rise and rise of Aldi and Lidl.

As Ibbotson adds: ‘Mike Coupe has no time to rest on his laurels though. Food price inflation has slashed margins, and with consumer prices rising at close to 3% a year and the consumption boom waning, retailers have to fight harder for every sale.

Yet for now the integrated model is delivering in spades. Argos is no longer a ‘get out of jail' card for the struggling Sainsbury’s brand, but an equal partner in a truly impressive double act.'