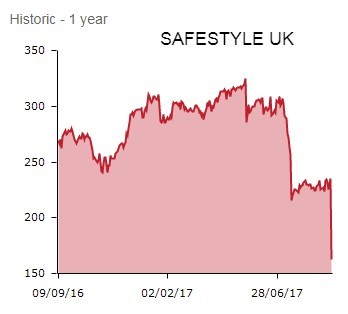

Windows and doors maker Safestyle UK (SFE:AIM) is at the sharp end of the downturn in big ticket spending, reporting its third profit warning within five months. That sends the shares 29% lower to 167.9p.

Analysts are slashing forecasts as the £195m cap warns of flat full year sales and margin pressure ‘leading to a material impact on full year profits'.

FEEDING THE BEARS

Providing additional fodder for retail sector bears, who’ve feasted on warnings from DFS Furniture (DFS) and Dixons Carphone (DC.) over the summer amid a clear UK consumer squeeze, the alert also inflicts pain on Safestyle shareholders ranging from Baillie Gifford, AXA and Artemis to Miton and Standard Life.

Since its last profit warning (18 Jul), where Safestyle bemoaned uncertain market conditions and weaker consumer confidence, ‘the group’s order intake has declined beyond the board’s expectations’.

Steve Birmingham-steered Safestyle blames the slump in orders on trading disappointment on ‘an accelerating weakness in the market resulting from increasing consumer caution, as evidenced by the latest FENSA statistics, which show that the overall market has deteriorated further, with installations down by 18% in June and July compared to 2016.’

Annual profits will reflect a deterioration in margins due to negative volumes, the need to increase digital recruitment spend and higher credit penetration in the mix.

READY FOR RECOVERY?

Safestyle has continued to grow market share and insists it ‘remains well positioned in the event of a market recovery’.

The company continues to churn out cash and has ‘a significant cash balance’, so there’s good reason to believe the dividend will be maintained, so long as trading doesn’t deteriorate even further.

Nevertheless, analysts are pushing through savage downgrades this morning. For instance, N+1 Singer’s retail sector sage Matthew McEachran reiterates his ‘sell’ rating and downgrades his price target from 225p to 180p.

For the year to December 2017, McEachran downgrades his pre-tax profit estimate by 17.5% to £16.5m and his 2018 estimate by 18.6% to £17.5m.

‘Year-end net cash is downgraded 17% and 24% respectively, but remains robust at £12.8m this year rising to £16.8m in full year 2018,’ says McEachran, who therefore assumes the dividend will be held at 11.3p this year and next.

On the bombed-out share price, that implies a yield of 6.7% which may entice risk-tolerant recovery investors.