Rolls-Royce (RR.) shares soared on Friday 15 June after the jet engine maker claimed cost and job cuts should see it beat targets of £1bn of free cash flow by 2020.

By 10am the share price is up at 977.2p, showing a giant leap forward of more than 10% in early trading today, by far the best performing FTSE 100 company in share price terms. This could go down as the firm’s best share trading day for two years or more presuming the early gains hold.

Rolls-Royce is holding a capital markets day on Friday where it will catch up with investors and City analysts. Ahead of that meeting the company issued an upbeat statement on future cash flow and costs.

Rolls-Royce announced 4,600 job cuts on Thursday 14 June, most of which will fall on middle management and admin positions at its state-of-the-art facility in Derbyshire.

STRAIGHT TALKING

‘The company does a good job of laying out what improved cash generation will mean for individual shareholders over the longer term, with an ambition to generate more than £1 per share of free cash flow against just 15p in 2017,’ explains Russ Mould, investment director at trading platform AJ Bell.

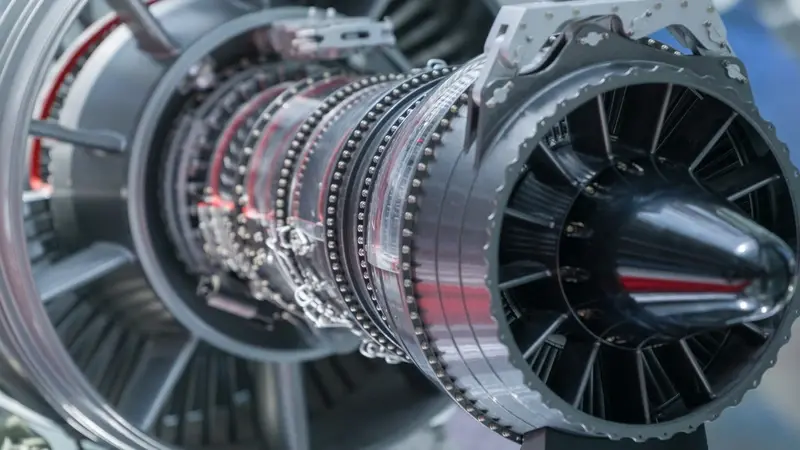

There has been plenty of news for Roll-Royce shareholders to chew over the past few weeks, with safety inspection problems with the company’s Trent 1,000 engines that could incur a extra £100m of after technical issues were discovered.

Yesterday came confirmation of leaked news regarding the axing of 4,600 jobs as part of a restructuring. That news saw the share price rally 6.5% on Thursday, meaning the stock has gained 18% in two days.

Rolls-Royce is a Shares running Great Idea, pitched at 836.6p last month (10 May), which you can read here. In that story we argued why the share price could hit £10.00 levels in the coming months.

‘The best measure of a company’s ability to create value for its shareholders is delivering a return on capital greater than its cost of capital,’ says AJ Bell’s Russ Mould.

Little wonder then that investors are very encouraged by targeted cash flow return on invested capital of 15%, far above the 9% reported last year, and ‘likely a long way ahead of the cost of funding the business through equity or debt,’ says Mould.

INVESTORS BUYING THE UPBEAT LINE

The confidence of chief executive Warren East and his team comes after a decade of hefty investment in its civil aerospace business to secure a leading position for its engines in the passenger jet market. East believes that Rolls has now become the senior player in an effective duopoly with rival General Electric.

‘For all the criticism of former management, and there is no question Rolls-Royce endured a troubled period before East took over in 2015, they deserve credit for leaving this legacy,’ says AJ Bell’s Mould.

‘The company has laid out clear measures of performance upon which this management team will be judged. Now it is time to deliver,’ concludes Russ Mould of AJ Bell.