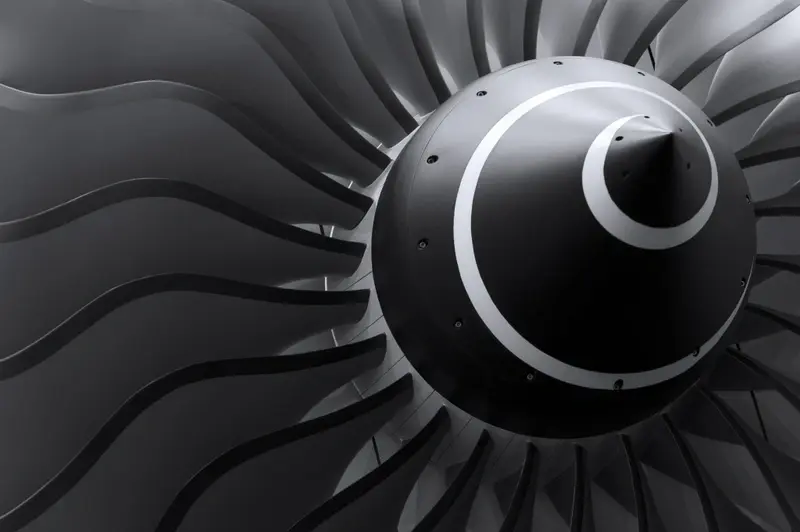

In a widely expected move Rolls-Royce (RR.) has announced plans for a big fundraise as it looks to secure sufficient liquidity to see it through the current crisis. Its shares slumped 10.4% to 116.8p on the news.

The plan is to raise approximately £2 billion through a fully underwritten 10 for 3 rights issue, aimed at improving liquidity and reducing balance sheet leverage.

It also plans to raise a further £1 billion through debt issuance ‘in the near future’, and has agreed a new two-year loan facility of £1 billion conditional on the success of the rights issue.

Rolls, which had been looking to get back on its feet under the leadership of CEO Warren East after a difficult period in the mid-2010s and more recent issues with its Trent 1000 engines, has been devastated by the coronavirus pandemic which has seen demand for its aircraft engines and spares and repairs services collapse amid an effective grounding of the aviation sector.

FALL FROM GRACE

Today’s fall in the share price extends the year-to-date decline to 82.7%. This is a business which until relatively recently was valued at upwards of £20 billion and held a position as a bastion of the FTSE 100 - at its current valuation it is in danger of being relegated from the index.

AJ Bell investment director Russ Mould commented: ‘There are two factors to consider - the first is how long it will take for demand to return for plane travel. Airlines need to see sales improve to restrengthen their balance sheets. And that leads to the second factor - in general they can’t think about ordering new planes, and therefore engines, until they are in a much stronger position financially.

‘It could be a long waiting game for Rolls-Royce, hence the need to boost its liquidity now to see it through potentially three or four years of further depressed activity.’