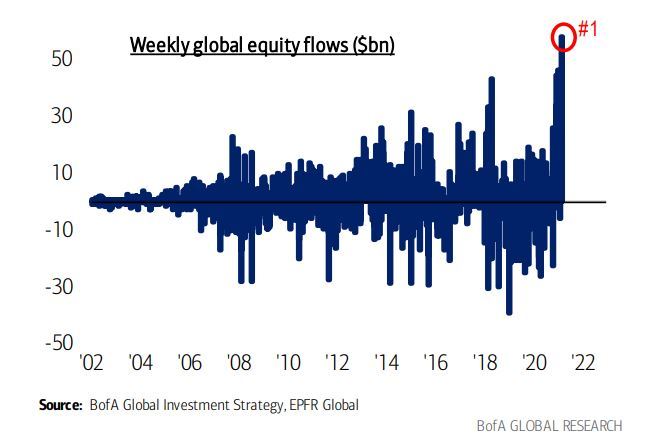

The opening week of February saw record-breaking cash flood into global equities, according to Bank of America’s global research team, with technology stocks topping sector inflows.

Almost half of the the total $58.1 billion equities inflows went into US large-cap stocks ($25.1 billion), the second-highest figure on record. US small-caps saw $5.6 billion, the third highest figure on record.

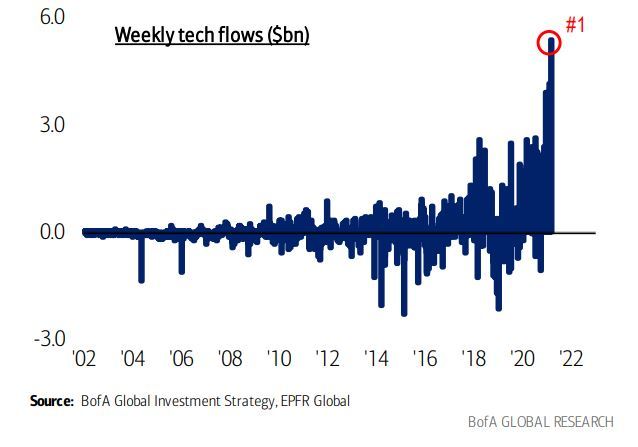

TECH STILL HOT

Technology stocks posted their best ever week of inflows at $5.4 billion, while flows into bonds reached $13.1bn, pushing the yield on US ‘junk’ or sub-investment grade loans to below 4% for the first time in history, despite a 33% increase in issuance compared with 2020.

Part of these inflows were financed by investors taking $10.6 billion out of their cash holdings, with Bank of America noting it saw the biggest drawdown of cash by its private clients since September 2019.

Investors also withdrew $800 million from gold funds, marking the first month of net outflows in two months.

BEARISH SIGNAL?

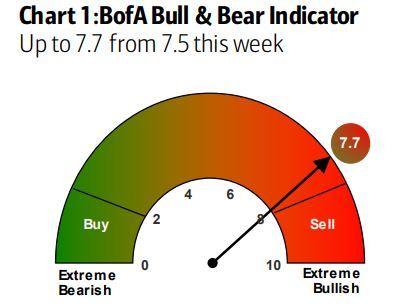

The bank also flagged that its Bull & Bear Indicator had moved another notch towards Sell territory, from 7.5 to 7.7, with a reminder that the last time the indicator gave a ‘contrarian’ Sell signal was 30 January 2018.

The median three-month return from a ‘Sell’ signal, of which there have been 12 since 2000, is minus 9% for global stocks and minus 45 basis points or 0.45% for the US 10-year Treasury yield, as investors dump stocks for the safety of US government bonds.