Pubs group Mitchells & Butlers (MAB) plans to raise £350 million of extra funding as it struggles to cope with the extended lockdown.

The All Bar One and Nichols bars owner will issue 167 million new shares at 210p via a pre-emptive open offer to all shareholders. But the cash call will represent a massive 36% discount to Friday’s closing price, illustrating the crushing impact that the UK’s forced closure of pubs, among other businesses, is having on the company.

The proposed share sale follows the company’s announcement on 7 January that it was exploring an equity issue. Broker Numis re-warned clients to expect an imminent fund raise in a research note on 12 February.

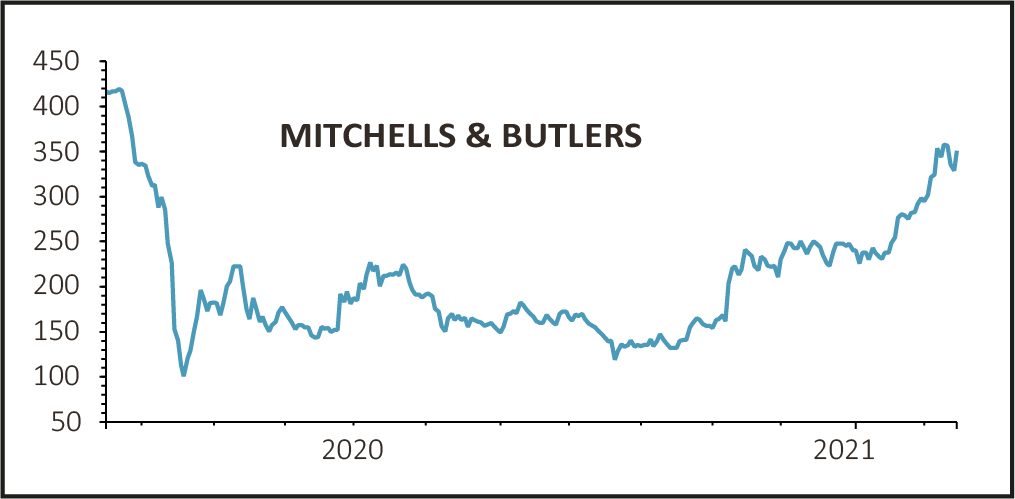

The proposed new funds are being fully underwritten by a controlling consortium, which has pooled its stakes under a consortium banner. This removed any uncertainty over the extra cash, helping shares in the business to rally nearly 7% to 351p, close to highs not seen since before the pandemic.

CHANGE OF CONTROL

The offer will increase the number of shares by 39% to 597 million shares. The company’s three largest shareholders which collectively control 55% of Mitchell’s and Butlers have formed a concert party and consolidated their respective shareholdings into a new consortium called Odyzean Limited.

Odyzean has indicated its intention to make available the whole £350 million so that the open offer will be fully subscribed in all circumstances.

In addition, the consortium will review the composition of the board of directors which may result in the removal of independent non-executive directors in future, to ‘streamline decision making.’

EXTENDED FACILITY

Mitchell’s & Butlers has agreed a new three-year unsecured £150 million revolving credit facility with its banks which replaces the current one which was due to expire at the end of 2021.

The refinancing is conditional on a successful fund raise and includes amendments and waivers under the company’s secured lending facilities.

The company’s lenders have given their consent to the technical change of control while the Takeover Panel has indicated that Odyzean isn’t required to make a mandatory offer for the company and is free to make additional purchases.

Increased financial headroom and the prospect for profitability to return sooner than expected on pent-up demand as hospitality reopens is a positive development for the business.

However, the emergence of a dominant shareholder and potential removal of independent directors is a worrying development for minority shareholders.

Shore Capital’s retail expert Greg Johnson said ‘the shares could be worth circa 330p to 340p per share on a fully recovered basis, however, we would expect the shares to trade at a marked discount to reflect the uncertainty, especially given the shareholder structure.’