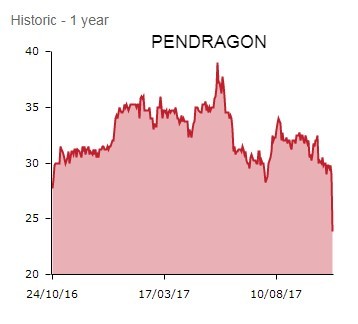

Motor retail giant Pendragon (PDG) warns full year profits will come in at around £60m this year. That is more than 20% down on the £75.4m made in 2016 and triggers a 17.2% share price crash to 24p.

Nottingham-headquartered Pendragon has been hit by a slump in demand for new cars amid waning consumer confidence, as well as a consequent price correction in the used car market.

In a third quarter update, the UK’s biggest car retailer says it expects full year underlying profit before tax to be ‘approximately £60m’, while anticipating a resumption of profits growth in 2018.

In the quarter, the £413.7m cap, which trades as Evans Halshaw and Stratstone, merely broke even at the pre-tax level.

NEW CAR DEMAND SLIDE

At play is the decline in demand for new cars caused by the weak pound and consumer uncertainty, with falling used car prices also impacting the business.

Gross profits in new cars slumped 20.7% in Q3 on a like-for-like basis, while used car gross profit reduced by 20.3%.

In a gloomy outlook statement, Pendragon says it expects ‘the new car market to continue to decline this year and the first half of next year as car manufacturers continue to adjust to the reduced level of demand for new cars.’

In particular, Pendragon cites ‘unprecedented pressure on new vehicle margin’ in the premium sector, ‘caused by certain manufacturers continuing to force vehicles into the market despite softening demand’, with profitability also dwindling in volume franchises.

CEO and sector veteran Trevor Finn says that following a strategic review, his team is ‘now committed to focussing on reshaping the business to accelerate transformation. We are placing our software and online technologies at the heart of our business as a platform to fulfil customers' vehicle and servicing needs. We believe this strategy will provide more reliable and sustainable returns.'

Pendragon has slammed the brakes on US expansion. There will be no further acquisitions in the USA, where Pendragon represents the Aston Martin, Jaguar and Land Rover brands out in sunny California.

With technology taking an ever increasing role in car retailing and servicing, Pendragon is placing its online fulfilment platform, Pinewood.co.uk, front and centre of its strategy.

In terms of UK new cars, it is also conducting a strategic review of its premium brands to ‘evaluate by manufacturer the investment appeal of their franchise proposition’.

MARGIN RECOVERY

However, the autos seller insists: ‘Our business is underpinned by stable aftersales profitability’, the largest profit contributor, ‘and we expect our used car volumes to continue to grow as we make progress on our goal to double used revenue in the five years to 2021. We are pleased to see our used margins are now recovering.'

Pendragon also announces that chairman and non-executive director Mel Egglenton has stepped down ‘for personal reasons, with immediate effect’, with senior independent director Chris Chambers hopping into the chairman’s seat.

Shares in rival quoted car dealers are down on the negative read-across; Inchcape (INCH) is off 4.4% at 784.5p, Lookers (LOOK) trades 4.9% lower at 102.5p, while Vertu Motors (VTU:AIM) cheapens 0.5p to 42p.