The boss of non-life insurer and employee benefits provider Personal Group (PGH:AIM) has welcomed the government’s investigation into the salary sacrifice industry.

Salary sacrifice lets an employee dodge paying tax and national insurance through an employer deducting money from the payroll to spend on certain benefits, such as child care or a pension.

The government is looking into narrowing the range of benefits that the system offers. Chief executive Mark Scanlon admits that this has led to some clients adopting a wait and see approach before discussing new business with Personal.

‘When you live in a world where you can salary sacrifice double glazed windows you know it has gone too far,’ Scanlon says.

‘We prefer to have a clean edge so everyone knows how it works and that it is straight forward.’

He hopes to hear news on the government’s plans in this area during the Autumn Statement on 23 November.

Scanlon spoke to Shares following the release of Personal’s first half figures to 30 June, which proved to be a record period for the group’s core insurance division.

New business generation increased 12.5% to £6.3 million, helping premiums to rise to £15.6 million from £13.8 million in 12 months.

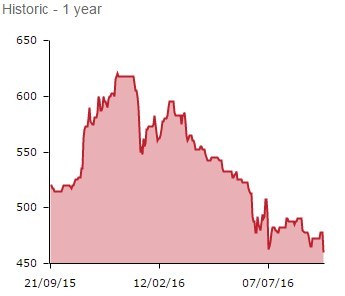

Shares, however, slipped 3.6% to 460p due to pre-tax profit shrinking 33.5% to £1.9 million. This is partly the result of management ramping up investment in Hapi, an employee benefits platform it is preparing to launch for accounting software specialist Sage (SGE).

News that Personal is ditching its underperforming mobile phone offering has also been poorly received by the market at a time when the government plans a crackdown on the salary sacrifice industry.