There were gains wherever you looked in the oil and gas sector on Friday as oil prices surged following the shock decision by OPEC and its allies not to increase supply (4 Mar).

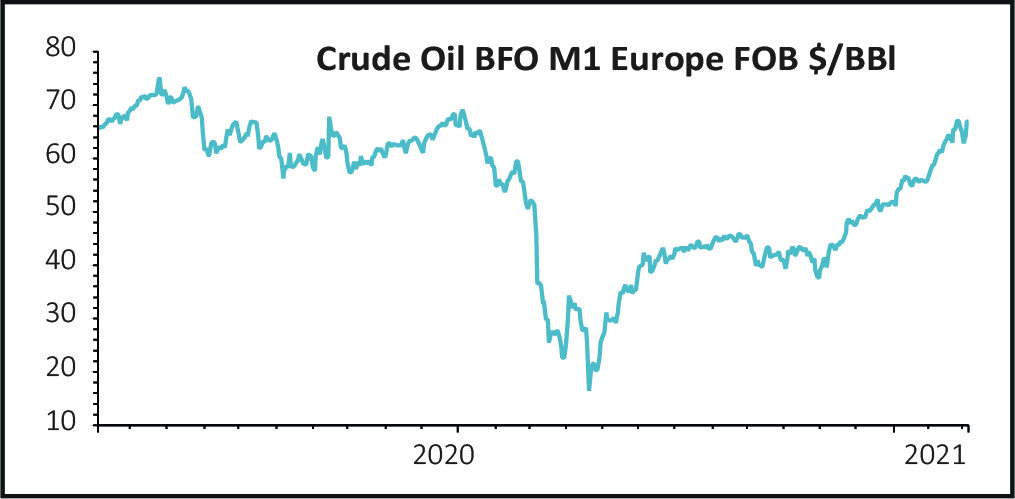

Brent crude is moving close to $70 per barrel in the wake of that call, the last time it traded above that level was pre-pandemic in January 2020 when tensions between the US and Iran hit fever pitch.

The increase in the oil price is adding to wider market jitters about inflation but is proving a fillip for oil and gas companies. The table shows some of the top risers so far today.

Stocks like Tullow Oil (TLW), EnQuest (ENQ) and Premier Oil (PMO) are particularly leveraged to the oil price thanks to their elevated debt positions.

Drivers for the recent leg higher in oil have included OPEC’s tight control of supply, weather-related disruption to key oil producing parts of the US and expectations for a rapid return in demand as economies reopen following the pandemic.

However, some observers think the spike in oil could be short-lived. Capital Economics assistant commodities economist Samuel Burman commented: ‘Slower demand growth and an abundance of supply will limit gains in oil prices over the long term, which we think will ultimately prevent oil from featuring in the next commodity super cycle.

‘Instead, we think that if the move to a greener economy leads to a super cycle in prices, it would be confined to metals given the much brighter demand prospects as well as supply constraints.’